In this article [Gen-Z summary]:

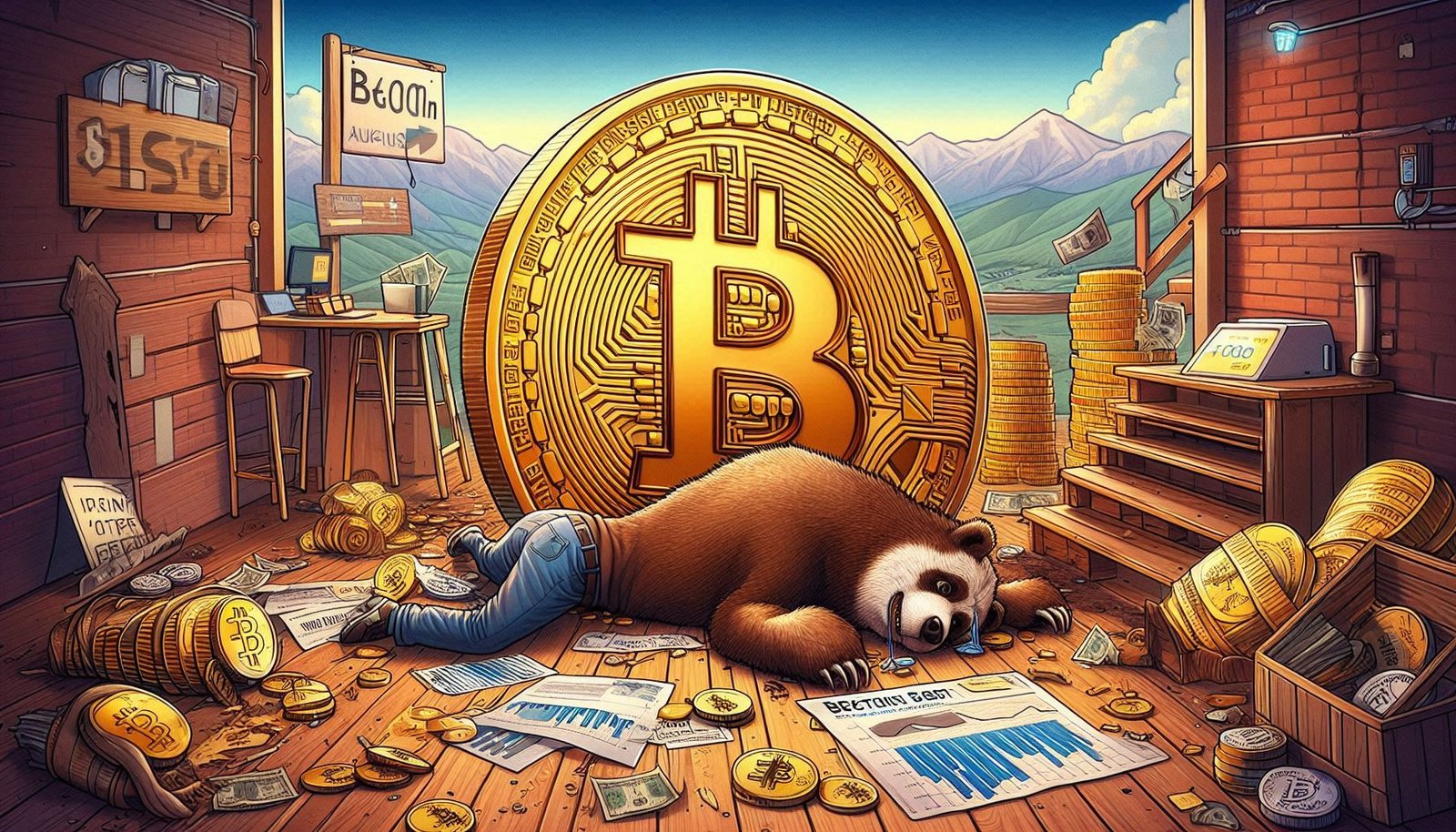

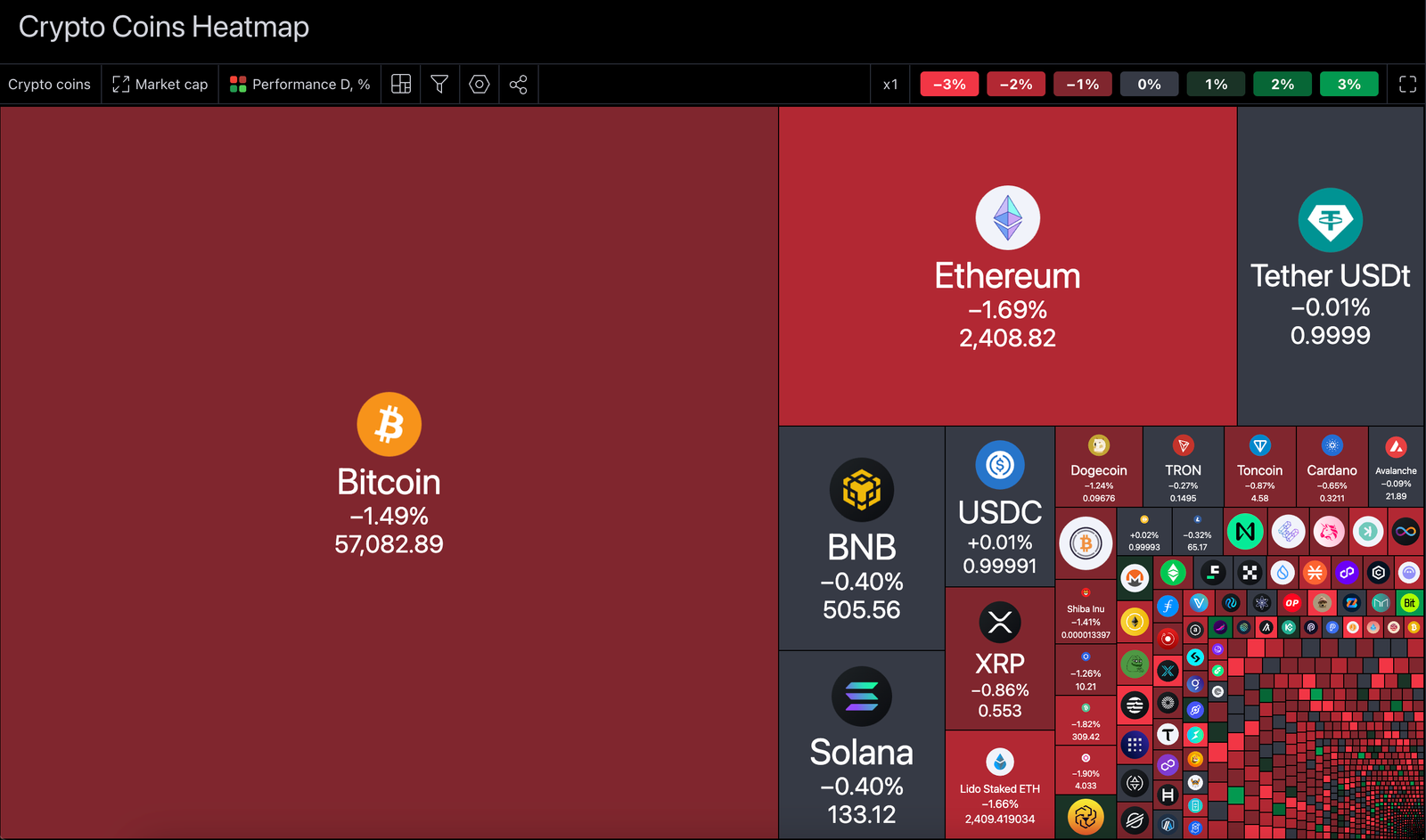

Bitcoin’s been on a rollercoaster ride. After the halving, prices took a nosedive. We’re in a crypto slump, and September’s not helping. But hey, when everyone’s freaking out, it might be a good time to buy.

Usually the crypto market uptrends after the halving events of Bitcoin. In 2016 and 2020, Bitcoin continued to rise above the price of halving day.

But this time is a different scenario. Bitcoin was at $63.5k on the halving day of April 2024 and now $BTC is trading at $57,000. This bitcoin trend is dragging the whole crypto market down. Will this pain continue throughout September? Let’s find out.

September is probably the worst month for not only crypto but also for stocks. However, we should be alert that the bottom is nearby as September passes.

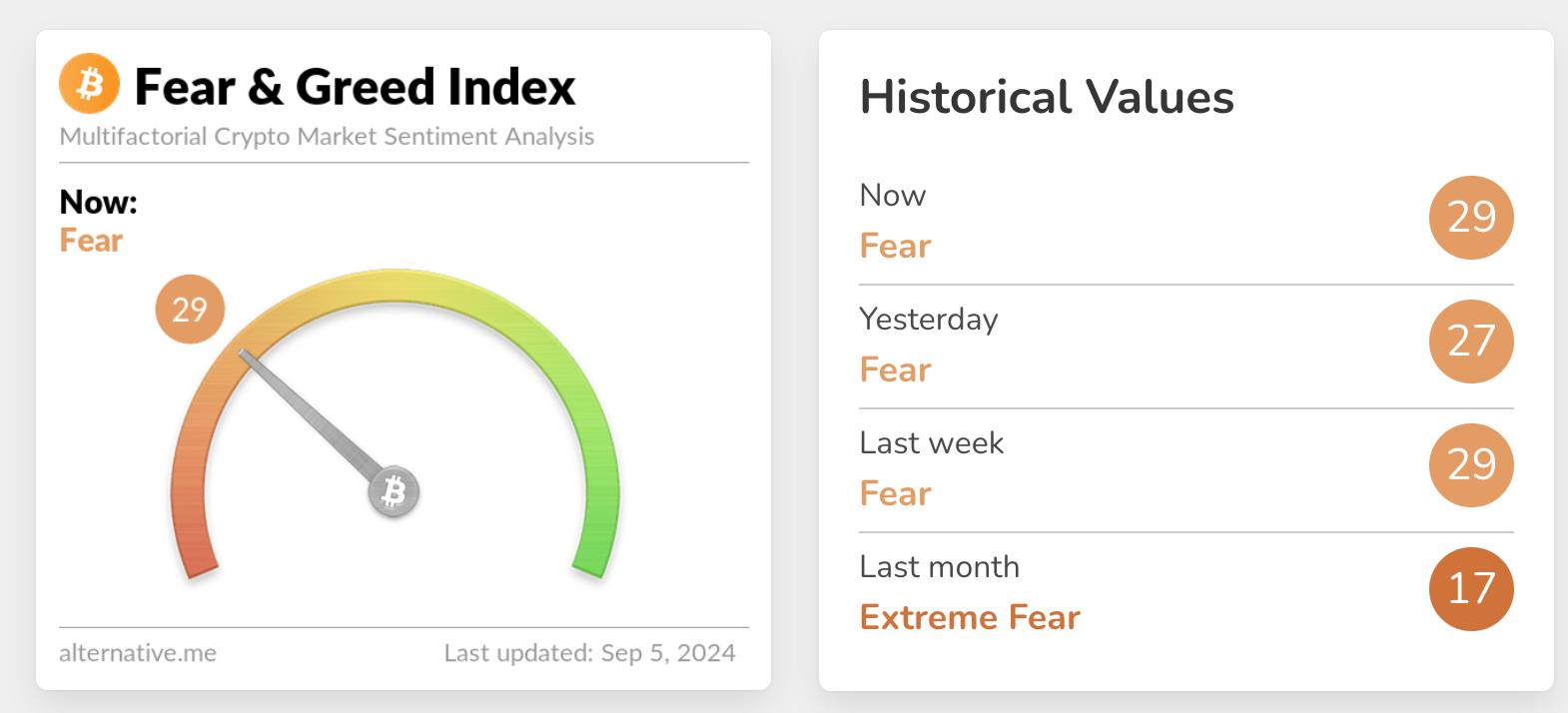

Fear & Greed Index is at 29. Last month was extreme fear at 17.

In these times, we need to remember one thing: “buy when everyone is fearful, and sell when everyone is greedy”. Is it the right time to buy or sell? Decide.

Everyone must remember what happens after September ends in halving the year of Bitcoin. If you don’t know this, check out the chart of Bitcoin on a monthly timeframe.

If you liked this article, then please subscribe to our YouTube Channel for web3 video tutorials. You can also find us on Twitter and Instagram.