Crypto World’s New Security Boss Just Dropped

If you thought blockchain was already safe, Immunefi’s here to prove it can be bulletproof. The onchain security beast guarding $180 billion+ in crypto just launched Magnus, an all-in-one real-time threat defense system—and yeah, it’s wild.

Magnus isn’t just another tool. It monitors heavy-hitter protocols like Arbitrum, zkSync, and Curve, catching everything from social hacks to smart contract meltdowns. It combines Fuzzland’s fuzzing tech and FailSafe’s compliance scanning into one live dashboard. Real-time alerts. Full chain watch. Zero excuses.

Crypto Security Gets Its Main Character Moment

This is a power move. With cross-chain monitoring for Ethereum, Polygon, BNB Smart Chain, and more, crypto security now runs like a command center. Think AI-powered threat alerts piped into Slack or PagerDuty so devs don’t have to juggle tools or tabs during an attack.

CEO Mitchell Amador kept it real: “One dashboard can mean the difference between disaster and recovery.”

Even billion-dollar Bitcoin DeFi players like Babylon Labs and Lombard Finance are jumping on. Immunefi’s using its own dataset, Codexa, to keep threat detection sharp and futureproof.

In a year where crypto hacks have already crossed $142B, this crypto security launch might just be the turning point for protecting onchain money.

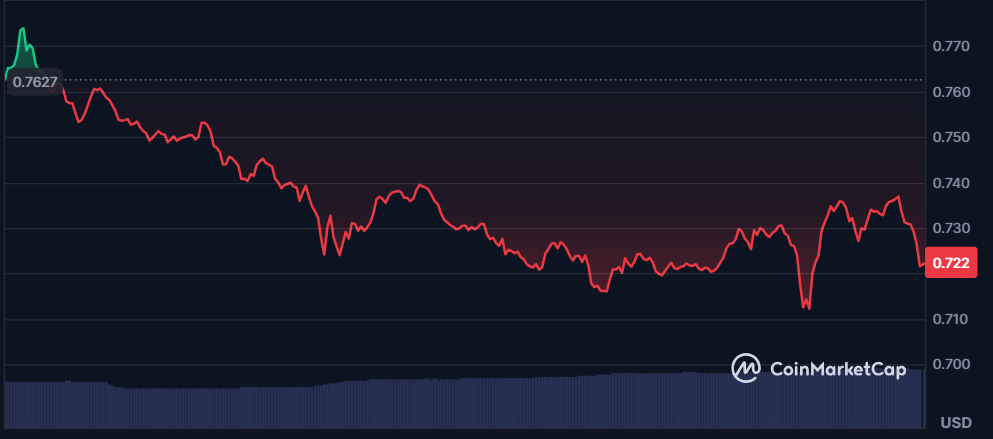

YOU MIGHT ALSO LIKE: Cardano Price Eyes Breakout as Analyst Spots 2021-Style Pattern Resurgence