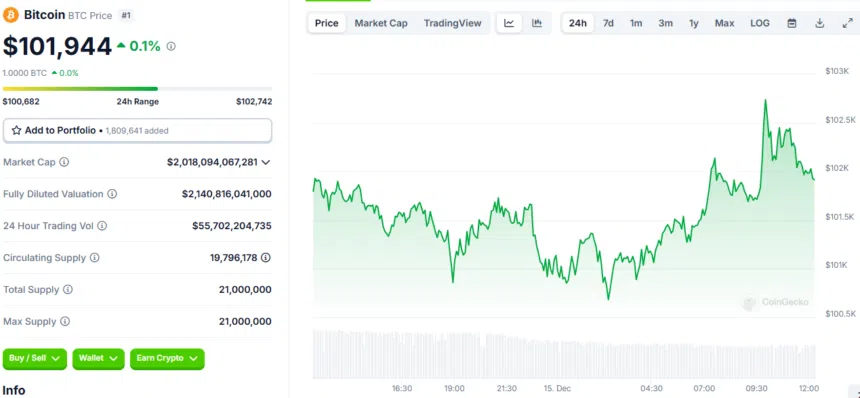

Summary: Bitcoin’s on fire and just inches away from making history. It’s trading at $101,935.76, only 1.4% shy of smashing its all-time high of $103,679, set barely 10 days ago. The question on everyone’s mind: is it about to level up or hit the brakes?

BTC’s Ultimate Glow-Up

Here’s the tea: Bitcoin’s market cap is sitting at a ridiculous $2.01 trillion, and the 24-hour trading volume is a cool $38.57 billion. And get this—in 2013, Bitcoin was worth a laughable $67.81. Fast forward to today, and we’re talking about a 150,000%+ climb. If that’s not the ultimate “started from the bottom” story, I don’t know what is.

The Hype Is Unreal

Crypto Twitter is going crazy, and even your grandma’s probably asking about Bitcoin by now. Investors are holding their breath like it’s the final season of their favorite show. If BTC breaks $103K, expect the FOMO to explode, with everyone from Wall Street suits to TikTok traders jumping in.

YOU MIGHT ALSO LIKE: Thailand is Going Full Crypto: Pay with Bitcoin While Chilling in Paradise

How High Can It Go?

Bitcoin isn’t just a coin; it’s a whole vibe. Whether it shoots past $103K or not, the buzz is unreal. Right now, it feels like the Super Bowl of crypto high stakes, all eyes watching. Wherever it goes next, one thing’s for sure: Bitcoin’s still the main character in the finance game.

YOU MIGHT ALSO LIKE: NFT Sales Surge 16% Amid Crypto Market Turbulence