Charles Hoskinson Just Threw Major Shade at Ethereum

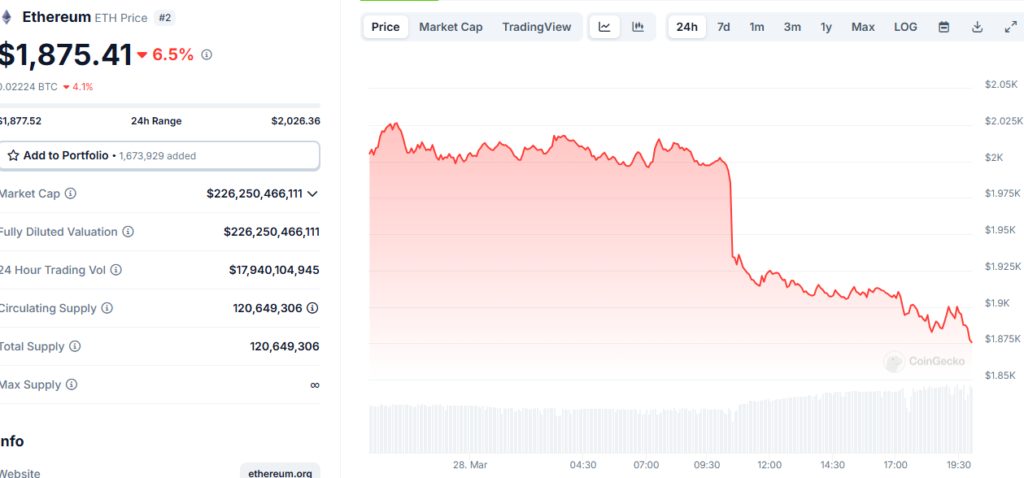

Ethereum’s got beef — and it’s coming from inside the house. Charles Hoskinson, OG co-founder of ETH and the mastermind behind Cardano, just dropped some savage takes in a recent AMA with Altcoin Daily. Spoiler: He’s not bullish on its future.

When someone asked him, “What would you have done differently if you were running the Ethereum Foundation?”, Charles didn’t hold back. He basically went full roast mode and called out:

- Wrong protocols

- Flawed accounting models

- Problematic consensus models

- Broken virtual machines

- No proper on-chain governance

- And a “parasitic” Layer-2 ecosystem

Yikes.

Ethereum = MySpace?

Charles literally said he doesn’t think it will survive another 10–15 years. Why? He believes Bitcoin’s DeFi game is leveling up fast and will start stealing the spotlight. Plus, its reliance on Layer-2s is apparently draining all its “alpha,” leaving the core chain to stagnate.

In his words:

“It’s like MySpace or BlackBerry — a victim of its own success.”

He also threw a little side-eye at Vitalik Buterin, suggesting it’s getting harder and harder for him to keep it together with just charisma and vibes.

Backstory moment: Hoskinson and Vitalik built the platform together in 2013, but Charles got booted the next year. His vision was to make it a for-profit company, while Vitalik was all about the nonprofit route. That drama still kinda lingers 👀

TL;DR:

Hoskinson thinks Ethereum’s got serious issues and might not make it to 2040. From bloated design to over-reliance on L2s and no real governance — it’s giving “end of an era” energy. And yeah, he thinks Bitcoin might just eat its lunch.

You might also like: XRP & Pi Network Surge as Bitcoin Approaches Awesome $95K