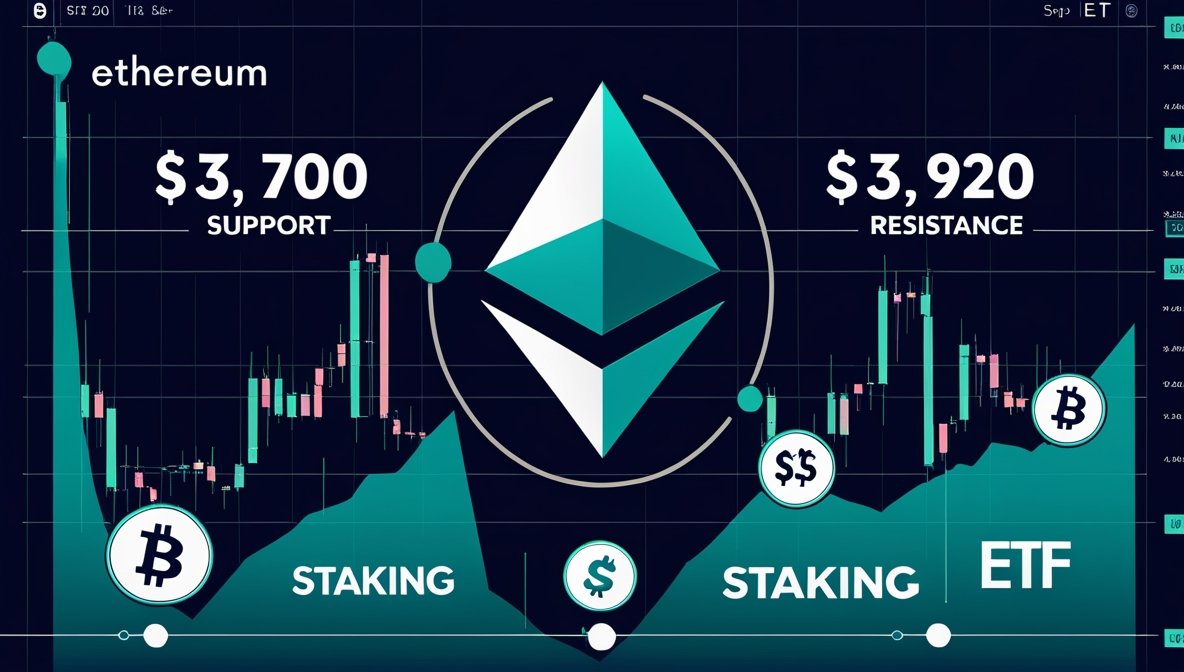

Our latest ethereum price analysis shows ETH trading around $3,696, after recently peaking at $3,848. A convergence of bullish data is fueling optimism—here are four bold triggers to track:

4 Bold Triggers in Ethereum Price Analysis

- Record Spot ETF Inflows

U.S. spot ETH ETFs recently recorded a daily inflow of around $727 million, pushing weekly inflows past $2 billion. These massive inflows signal serious institutional demand, tightening supply and underpinning price strength. - Strong Technical Breakout Patterns

Analysts are eyeing a descending trendline breakout, which one noted as “phenomenal”. Additionally, daily Heikin-Ashi candles show consistent upward momentum, suggesting resilient bullish structure. - Ascending Long-Term Chart Structure

ETH is forming a six-year ascending triangle on the monthly chart, with a horizontal resistance near $4,000 and rising support. A breakout above that target zone could set ambitious upside toward $6,000–$8,000. - Network & On‑Chain Strength

Ethereum’s network activity is near multi-month highs—daily gas usage, active addresses, and DeFi/NFT volumes remain elevated, supporting real utility demand. Meanwhile, ~36M ETH (~30% supply) is staked, tightening market float

Quick Take:

This ethereum price analysis highlights a robust bullish case. Institutional ETF capital, bullish technical formations, and strong on-chain metrics all point toward a breakout zone near $4,000. A volume-backed close above that range may open the path to higher targets ($4,200+). However, climate risk exists if momentum fades, potentially triggering a dip toward $3,500–$3,600. Monitor ETF inflows, breakout volume, and network usage for key signals.

YOU MIGHT ALSO LIKE: Michael Saylor’s Strategy Buys 6,220 More BTC, Now Holds $43B Bitcoin Fortune