Trump’s 50% EU Tarrif Plan Wipes $100B Off Crypto Market

The crypto world just got rocked—again. U.S. President Donald Trump’s shocking proposal to slap a 50% tariff on the European Union triggered a fast and furious market correction, wiping nearly $100 billion from the total crypto market cap.

Bitcoin (BTC), which recently flexed with an all-time high above $111K, dropped 3% within hours of Trump’s TruthSocial post. It’s now sitting around $108,530, with trading volume plunging 32% in 24 hours.

The ripple effect didn’t spare altcoins either. Major players like Ethereum (ETH), XRP, Solana (SOL), Dogecoin (DOGE), and Cardano (ADA) all slipped between 2-4%. The CoinMarketCap 100 Index dropped 2.84%, marking one of the sharpest declines this month.

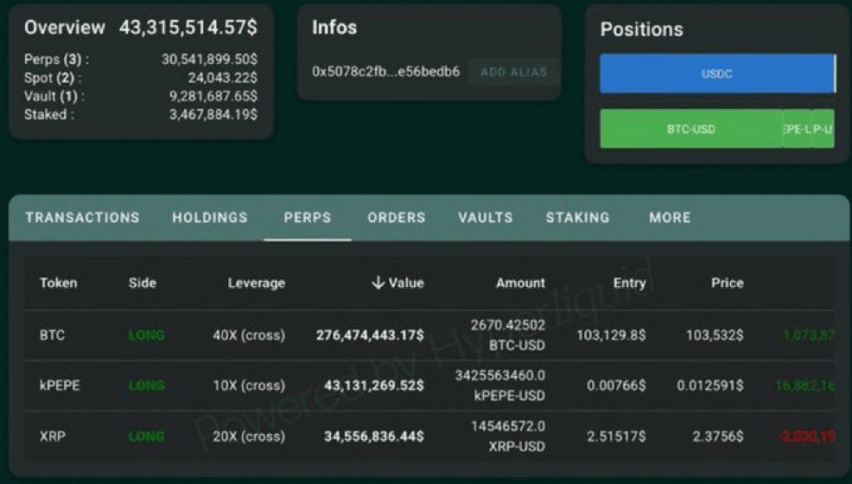

Traders got wrecked hard. Over $308 million in long positions were liquidated, and total liquidation—including shorts—hit a brutal $334 million in just four hours, according to Glassnode.

What Did Trump Say?

In a fiery post, Trump claimed the EU exists “to take advantage of the United States” through unfair trade practices. He called out their VAT taxes, trade barriers, and “ridiculous corporate penalties,” stating a 50% tariff would hit starting June 1, 2025—unless the goods are U.S.-made.

“There is no Tariff if the product is built or manufactured in the United States,” Trump said.

The crypto market reacted instantly—and violently. Global uncertainty? Check. Trader panic? Double check.

YOU MIGHT ALSO LIKE :Bitcoin Hits $112K: Bulls Charge Ahead