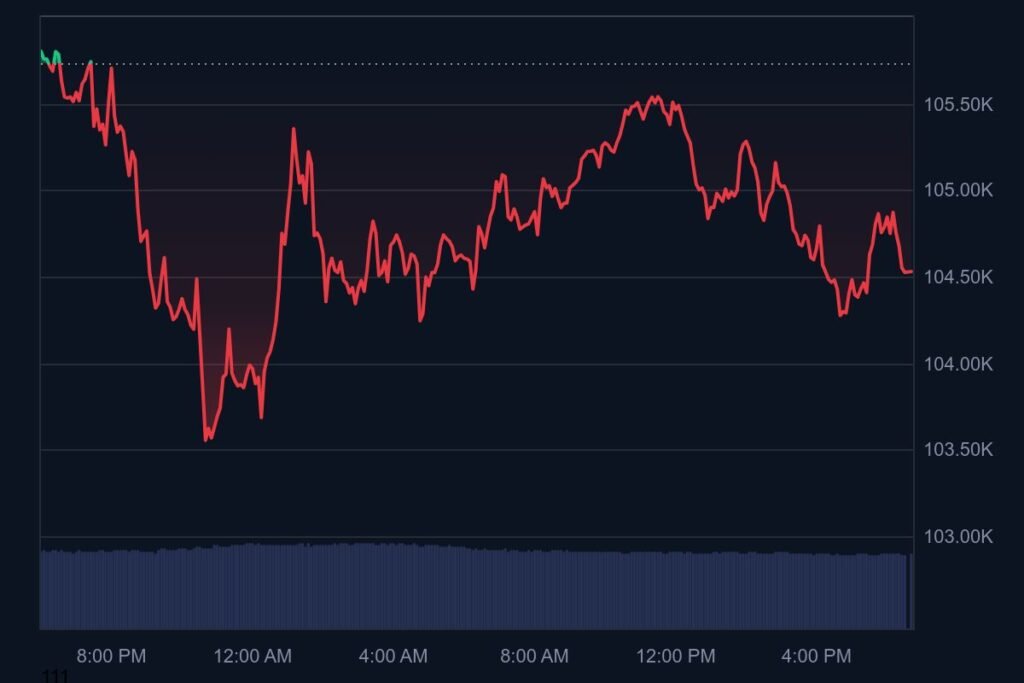

Bitcoin price today is trading around $107,900 after a high-volume rebound from the $107K zone. With a mix of ETF inflows, on-chain strength, and technical patterns, all eyes are on whether BTC can reclaim fresh highs.

4 Bitcoin Price Today Signals You Should Know

- Crypto ETFs Keep Flowing In

Spot BTC ETFs have recorded inflows for 11 straight sessions, adding $588 M this week and pushing IBIT’s ten-day total to over $1 B . - Support Holding Firm at $107K

BTC’s bounce from the $107K level has come on sustained volume. That zone now acts as solid support—holding above it is key for bulls moving forward . - Descending Channel with Breakout Potential

After a slowdown in May, BTC formed a descending channel. A clean breakout above its top trendline (approx. $109K–110K) could lead to a run toward $112K+ . - Hash Rate Hits New All-Time High

BTC’s hash rate reached record levels this week—emphasizing confident miner sentiment and reinforcing the stability of the network .

YOU MIGHT ALSO LIKE: Hal Finney’s $10M Bitcoin Dream: Just a Thought Experiment or Financial Prophecy?