$379M Liquidated in Crypto Market in 24H, Over 120K Traders Affected

More than $379 million worth of crypto positions were wiped out in the past 24 hours, impacting over 120,000 traders, according to data from CoinGlass. The sudden liquidations reflect heightened volatility and increased leverage across major crypto assets, with Ethereum (ETH) traders bearing the largest losses.

Ethereum Tops Daily Liquidation Charts

Ethereum traders lost over $122 million combined, split between $68 million in long positions and $54 million in shorts. Analysts believe the volatility near key resistance and support levels forced both bullish and bearish traders out of the market.

As ETH price hovers around technical zones with no strong breakout, both sides of the market were caught off guard.

Bitcoin Losses Lower, but Shorts Took a Hit

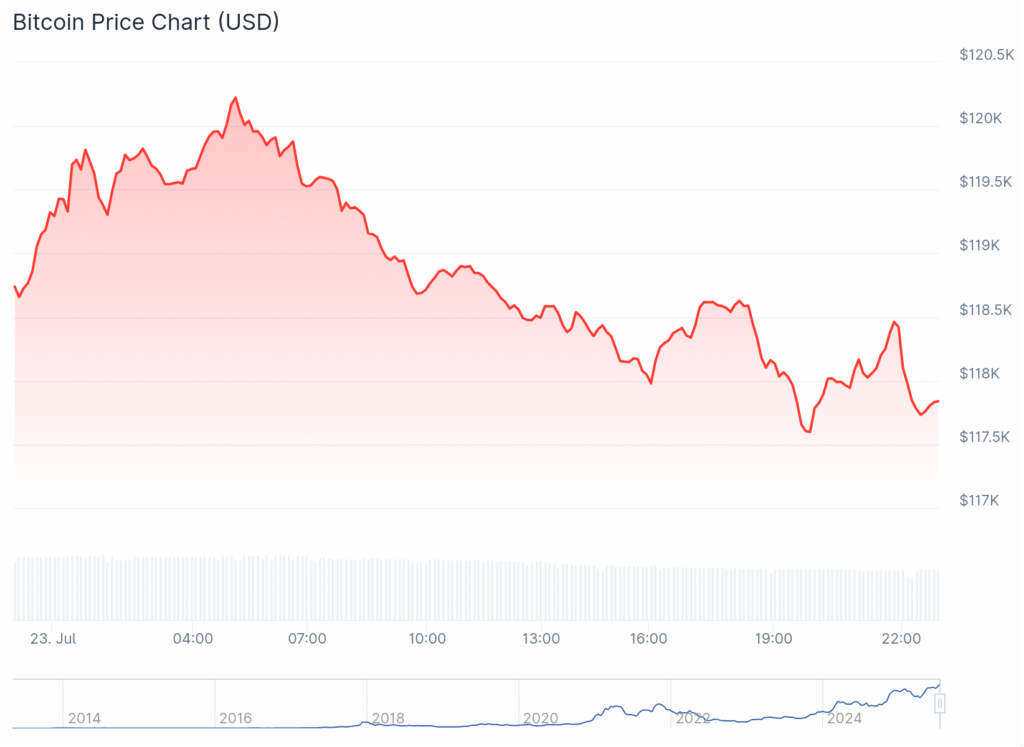

Bitcoin-related liquidations totaled $35.5 million, with most losses occurring on the short side. This suggests many traders expected a pullback, but BTC’s stability near all-time highs flipped expectations.

Despite the relatively smaller figure, Bitcoin’s resilience continues to squeeze out bearish positions as the market holds firm in bullish territory.

HTX Sees Largest Liquidation at $2.68 Million

The single largest liquidation recorded in this cycle was a $2.68 million short position on the ETH/USDT pair on the HTX exchange. Though Ethereum’s price movement remained muted, the high leverage involved triggered a full liquidation—highlighting the risks of overexposure.

This event reinforces the classic crypto warning: using borrowed capital can magnify both gains and losses—and even small price movements can lead to massive wipeouts.

2025’s High-Risk Trend Persists

The current liquidation event is part of a broader 2025 trend: increased leverage, more frequent margin calls, and high-volume liquidations amid uncertain macro conditions. Crypto markets are swinging fast, and overleveraged traders continue to suffer the consequences.

According to analysts, many of the 120,000+ affected traders were shorting the market. But instead of dipping, prices held or climbed slightly—just enough to trigger liquidations across major exchanges.

Final Warning: Leverage Carries Extreme Risk

This sharp $379 million wipeout serves as a reminder to traders: crypto can be calm one moment and devastating the next. Even without major news or market crashes, small price fluctuations can cause massive losses when leverage is involved.

Investors should remain cautious, especially when using margin or derivatives, as 2025 continues to see high volatility and quick reversals across digital assets.

YOU MIGHT ALSO LIKE: Insane !Ethena (ENA) Soars Over 130%: Bullish Breakout or Overheated Hype?