New Hampshire is cooking up some serious crypto heat. They just became the first U.S. state to say “yep” to investing public funds in it, thanks to a new law signed off by the governor on Tuesday.

Other states were thinking about doing it too, but New Hampshire beat everyone to the punch. Not only are they the first to give their state treasurer the green light to start a Bitcoin reserve, they might even flex on the federal government by stacking sats before D.C. does.

Governor Kelly Ayotte, who’s only a few months into her job, proudly posted on X, “New Hampshire is once again first in the Nation.” 🔥

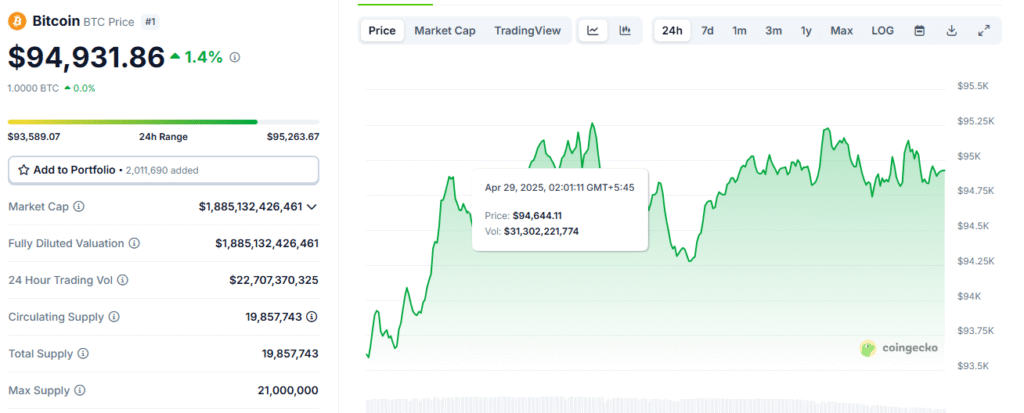

This new law lets the state throw up to 5% of public cash into any digital asset that’s sitting at $500B+ market cap—which, let’s be real, is just btc right now.

Dennis Porter, the guy behind the Satoshi Action Fund, is hyped. He’s been rallying lawmakers to make crypto reserves happen, and he told CoinDesk:

“The first one’s the hardest. Now that New Hampshire did it, others will follow.”

And he’s probably right. State House Republicans in NH also dropped a flex on X, saying they’re now the first state laying the foundation for a strategic BTC reserve. They even dubbed NH as “the Live Free or Die state leading the future of commerce and digital assets.”

Meanwhile, Arizona tried, but their governor vetoed it. Florida pulled back, and other states are kinda stuck. The only serious challenger left? North Carolina, where a big-name lawmaker is still pushing hard.

Even Trump is down with the idea. He’s called for a national Bitcoin reserve and a federal-level crypto stockpile. But Washington’s still figuring out what assets they can even shift into that.

So for now?

New Hampshire’s on top.

First in it. First to HODL with state funds.

And that’s some history being made.

You might like: Trump’s TRUMP Memecoin Drops 24% in a Week Despite Upcoming Gala