Wanna learn blockchain in simply 5 steps? Here is a guide.

1. What is Blockchain?

Blockchain is a digital ledger that records all and every transaction detail. This transaction detail is noted down on every participant of said blockchain which makes it nearly impossible to break through by outsiders. This system of information being scattered and saved on different networks is called a decentralized system. The transaction detail or any valid information on the blockchain system is stored in a block and several of these records are joined together by a chain, hence the name Blockchain. Every user on the network gets a copy of the entire blockchain making this digital ledger bulletproof.

2. How Does Blockchain Work?

Blockchain works on several computers called nodes, which validate the information( Mainly transactions). When a transaction occurs, its detail is bundled up with others in a block and several nodes scan the block as well as validate its integrity. Once the transaction is validated the block is added to the blockchain, forming a permanent record. This process ensures data integrity and data security of the whole block.

3. Smart contract

Smart Contracts are policies and rules that bind all the pieces of blockchain together. These are self-executing contracts with terms and conditions written into code. Once the terms and conditions are met this contract will automatically enforce itself, removing the need for Middle-Man during transactions. Smart Contracts provide transparency, security, and Immutability. This ensures that data cannot be altered without detection.

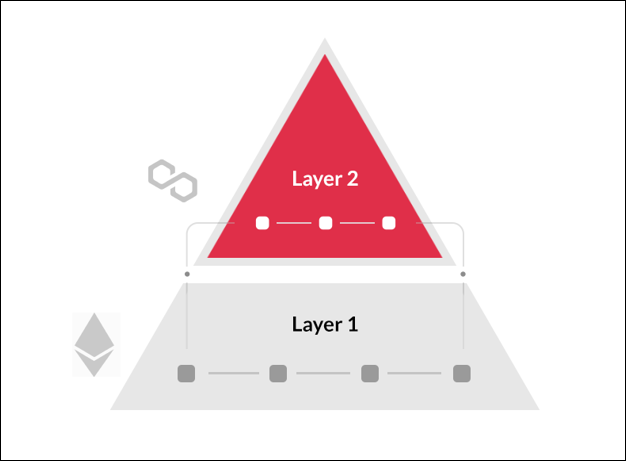

4. Layer-1 and Layer-2 Blockchains

I) Layer-1 Blockchains:

Layer-1 Blockchains are foundational blockchains that can establish, manage, and record all transactions on their own. Examples include Bitcoin, Ethereum, and Binance Smart Chain. Layer-1 Blockchains do face scalability and speed issues due to the limited number of transactions per second.

II) Layer-2 Blockchains:

Layer-2 Blockchains are simply upgraded and better versions of Layer-1 Blockchains. Layer-2 Blockchains are built on top of the base layer( Layer-1). They process transactions off-chain reducing the load on layer 1 and increasing its work efficiency.

5. Uses of blockchain

- Cryptocurrency

- Supply Chain Management

- Healthcare

- Voting System

- Finance

Conclusion

By understanding these 5 points, you’ll have a basic and general grasp of blockchain technology, including the difference between Layer 1 and Layer 2 blockchain.