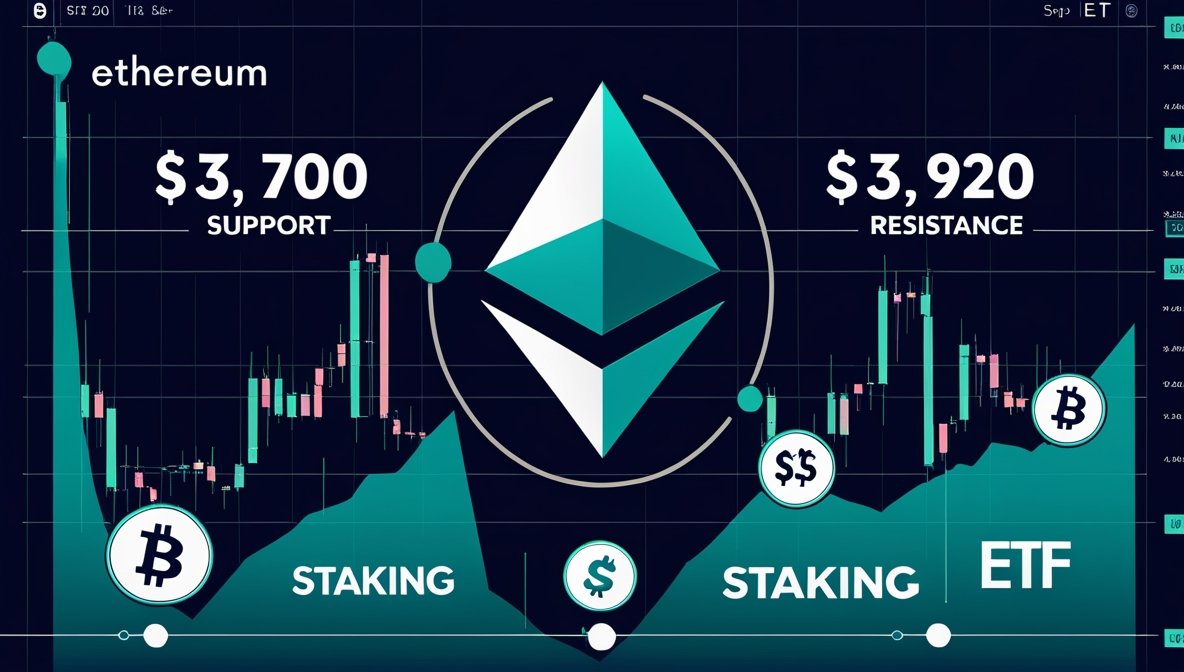

Ethereum price today is hovering around $3,800 following a strong bounce off the $3,700 range. With ETF chatter, staking pressure, and on-chain metrics lining up, here are four signals worth tracking that could steer ETH into fresh territory:

4 Ethereum Price Today Signals to Watch

- Bounce From Strong Support at $3,700

ETH reversed sharply from the $3,700 level twice today, signaling a solid demand zone. Holding above this makes it a crucial bull trigger point. - Resistance Forming Near $3,900–$3,920

Around the current price lies resistance between $3,900–$3,920. A breakout above with good volume opens the door toward $4,000–$4,100. - Staked ETH Supply Climbing

On-chain data shows a 2% increase in staked ETH over the past week—reducing circulating supply and raising scarcity. That often supports upward price moves. - Growing ETF Sentiment

Institutional discourse around a spot ETH ETF has increased. Recent filings and insider commentary are feeding bullish sentiment, even before any approvals.

Quick Take:

Ethereum price today is nestled between support at $3,700 and resistance around $3,920. With strong demand, growing staking, and ETF optimism, ETH is poised for a potential surge. A clean break above $3,900–$3,920 with volume could trigger a rally toward $4,000+. Watch flow and macro cues to see if ETH charges higher—or retests its floors.

YOU MIGHT ALSO LIKE: Is the U.S. Planning to Seize Ripple’s XRP Escrow for a National Crypto Reserve?