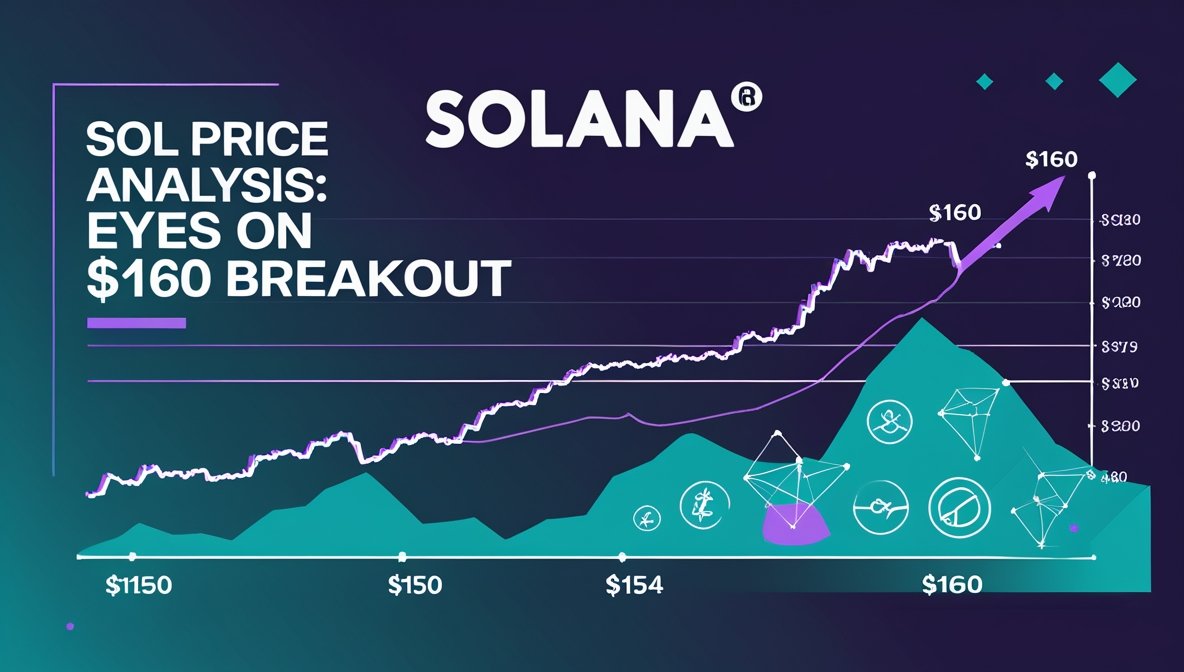

SOL is currently trading at $163.46, rebounding from earlier dips into the $158–$160 zone. Our solana price analysis highlights four pivotal signals that could determine whether SOL breaks higher—toward $180—or retests lower support.

4 Critical Signals in Today’s Solana Price Analysis

- Whale Accumulation Intensifying

On-chain data confirms that large wallets have been quietly accumulating SOL. Notably, the number of wallets holding over 10,000 SOL has jumped by 1.5% in the last week, and one whale wallet picked up 30,901 SOL after a period of dormancy—indicating growing long-term confidence. - Strong Support Forming Between $150–$154

SOL defended a key price band around $150–$154 multiple times recently. Buyers stepped in near $154 and supported a rebound, suggesting that this zone may now act as a reliable floor for bullish momentum. - Death Cross Sets $160 Resistance

Despite recent gains, a Death Cross—where the 50-day MA drops below the 200-day MA—remains intact near $160. This technical setup often caps upside unless decisively broken on strong volume. - Network Usage Hits New Highs

Solana’s ecosystem momentum is real: in June, Solana matched the combined monthly active addresses of all other L1/L2 chains and generated over $271 million in Q2 network revenue. That kind of on-chain activity underpins long-term demand for SOL.

YOU MIGHT ALSO LIKE: Insane ! Bitcoin Price Analysis: 4 Precision Signals Heralding a Move Toward $115K