Summary:

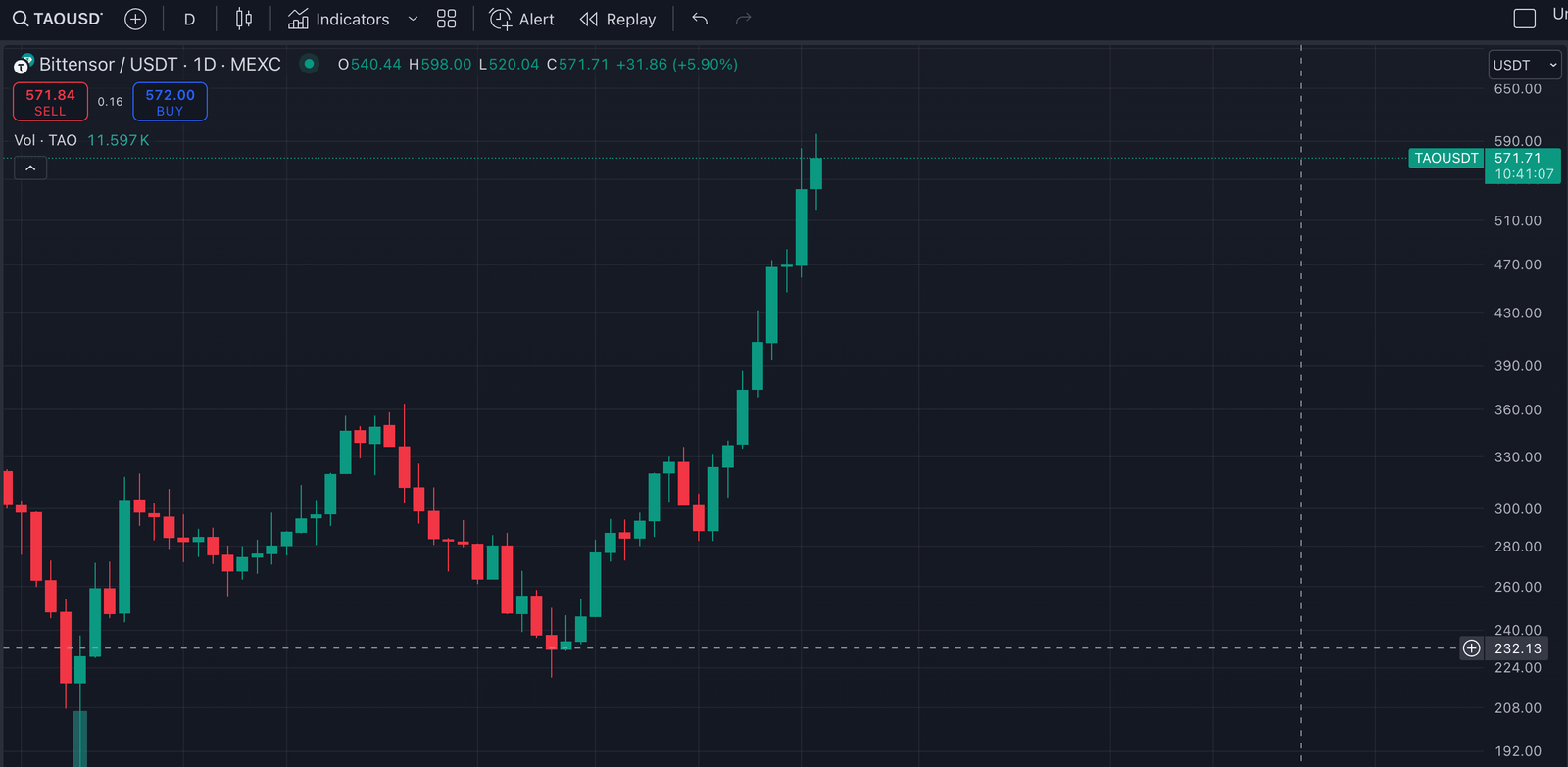

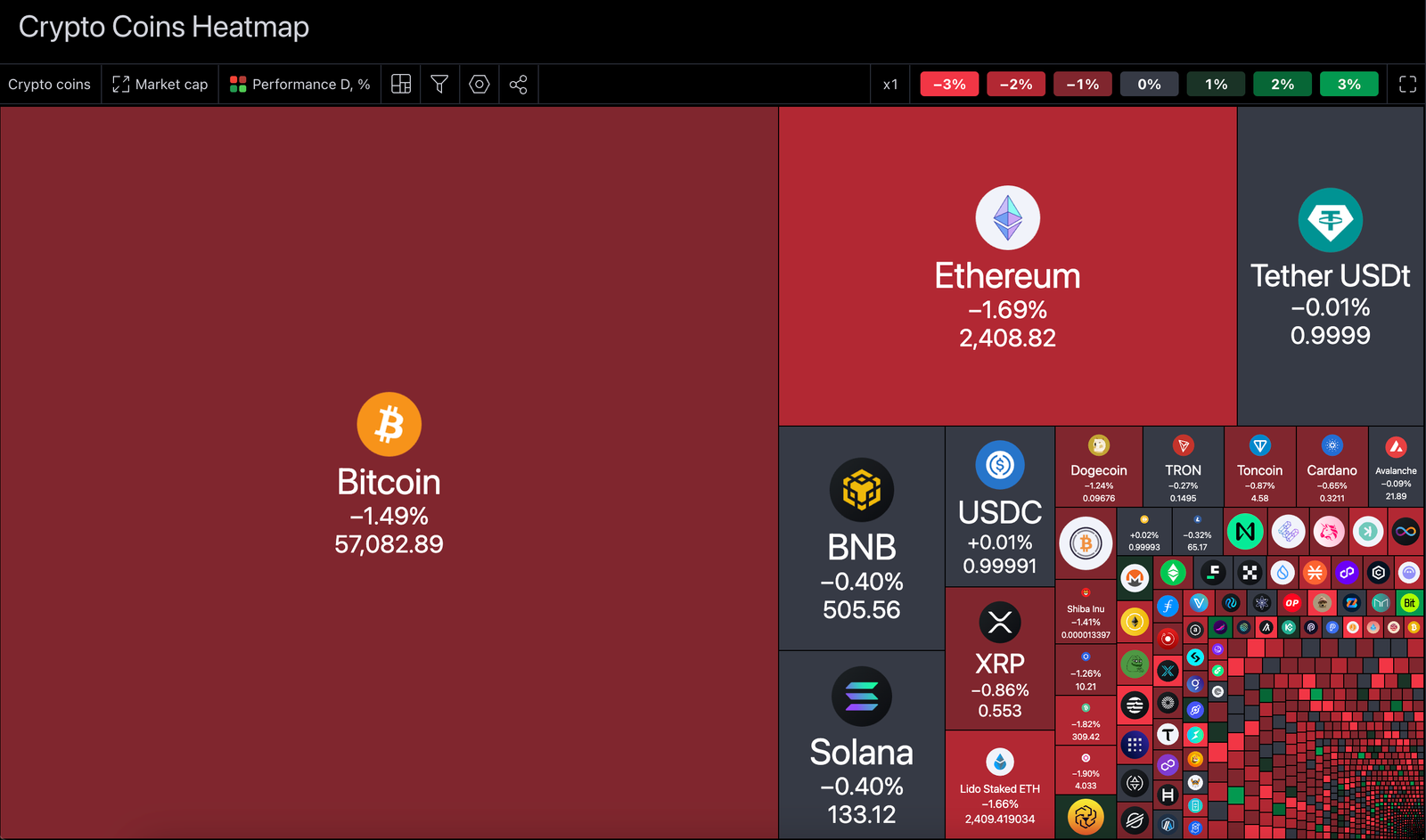

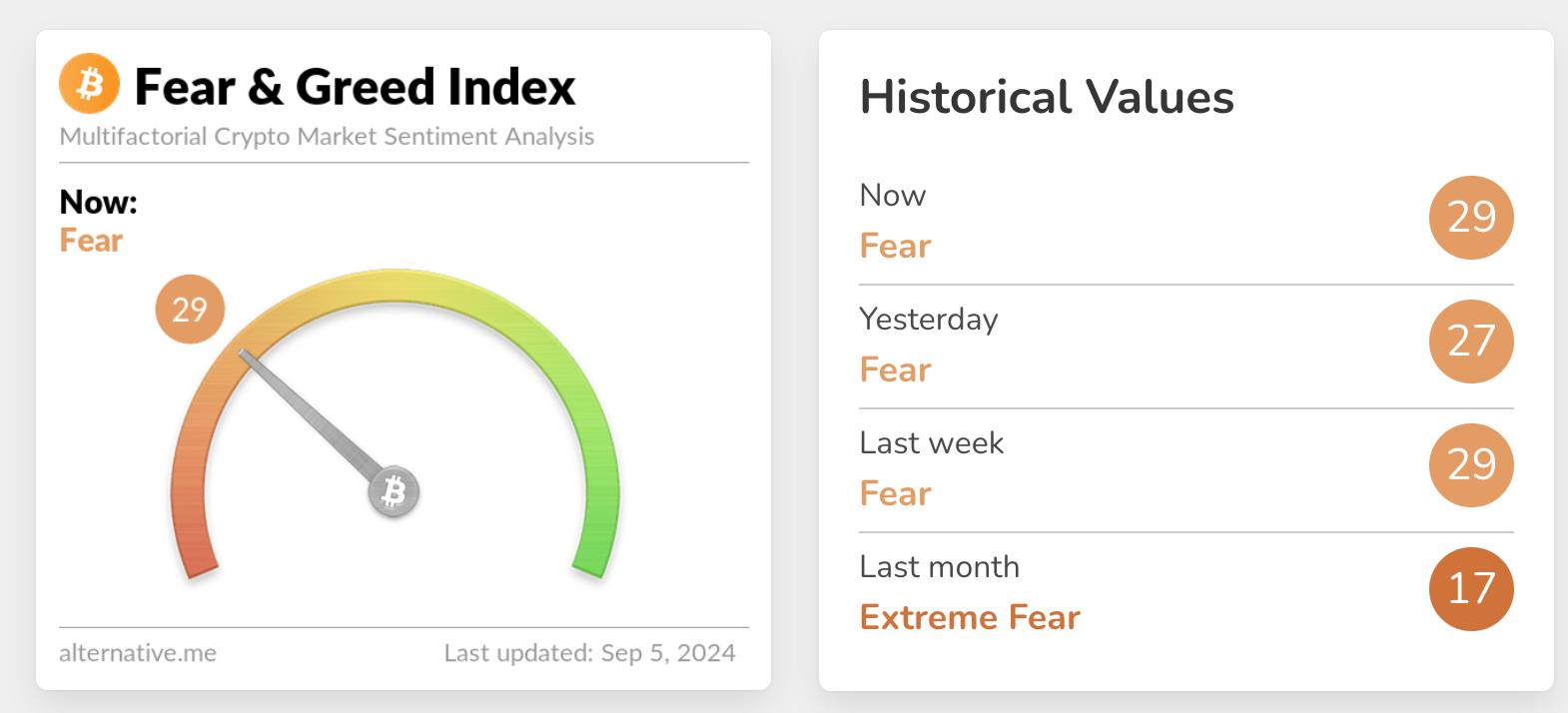

Gen Z, you already know Bitcoin’s been flexing hard, almost hitting $100K. But while the FOMO squad is scrambling, the OGs are chilling. Here’s the tea: long-term Bitcoin holders (aka diamond hands) just locked in over $2 billion in profits in a single day. But not all hodlers are rushing to cash out. Let’s break it down.Recent data from Glassnode indicates that most Bitcoin selling activity is being driven by newer holders, specifically those who have held their coins for 6-12 months. These so-called “semi-diamond hands” accounted for 35.3% of recent sell-offs. Meanwhile, long-term Bitcoin investors, often called “OGs,” are maintaining their positions, likely waiting for higher prices before considering any moves.

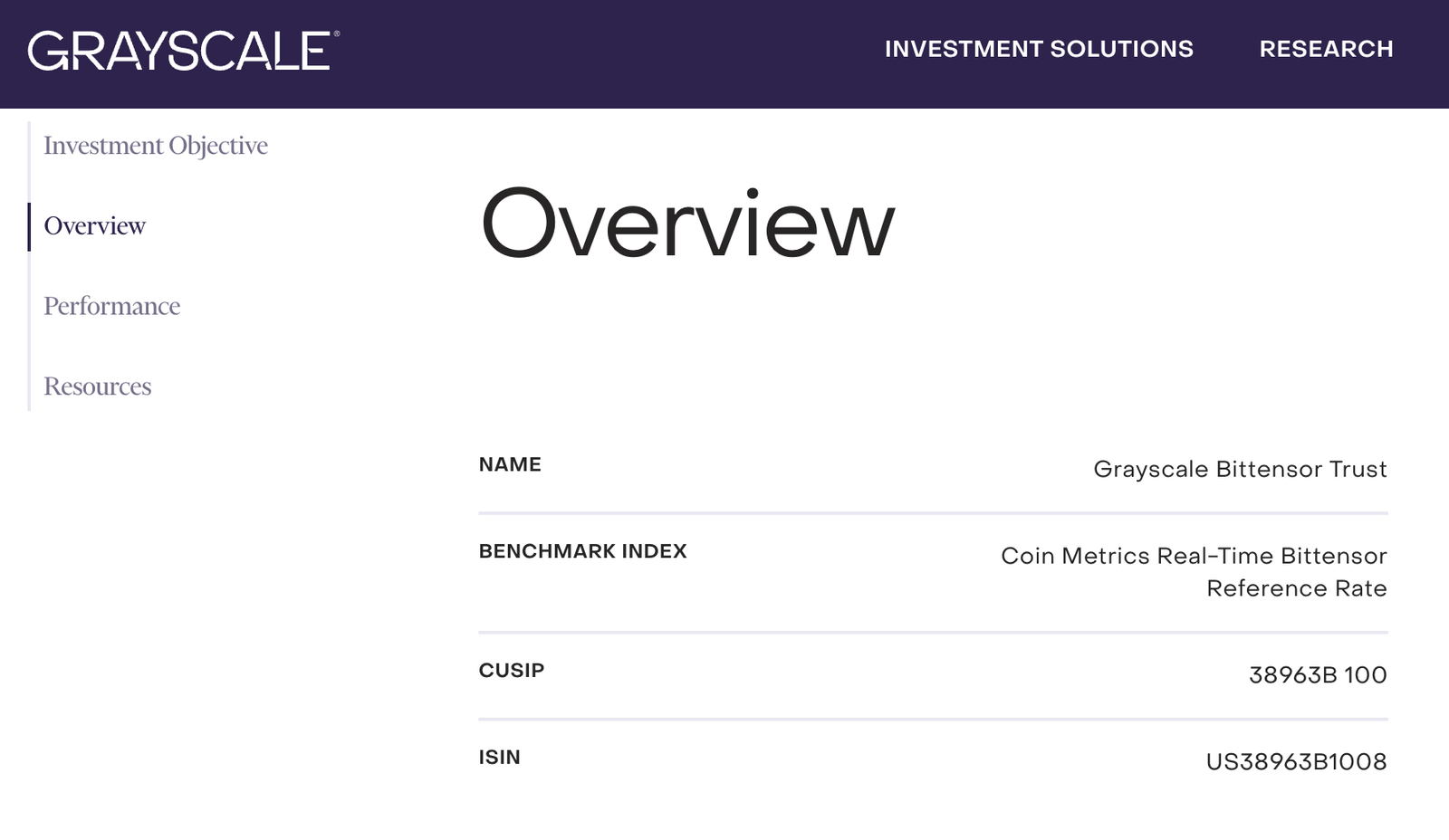

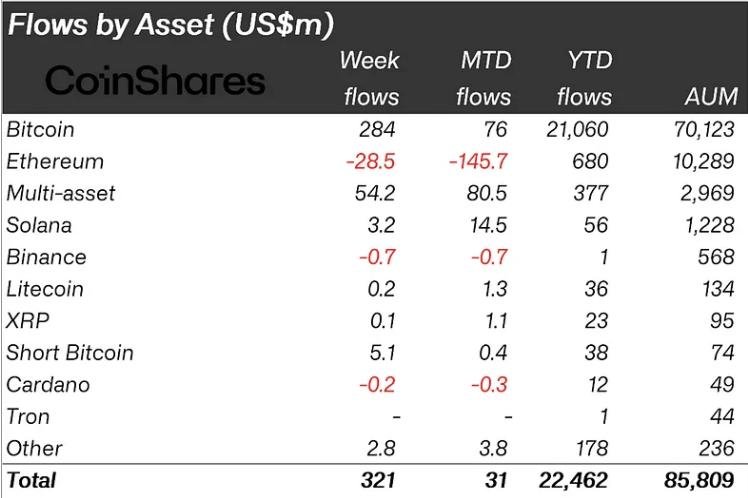

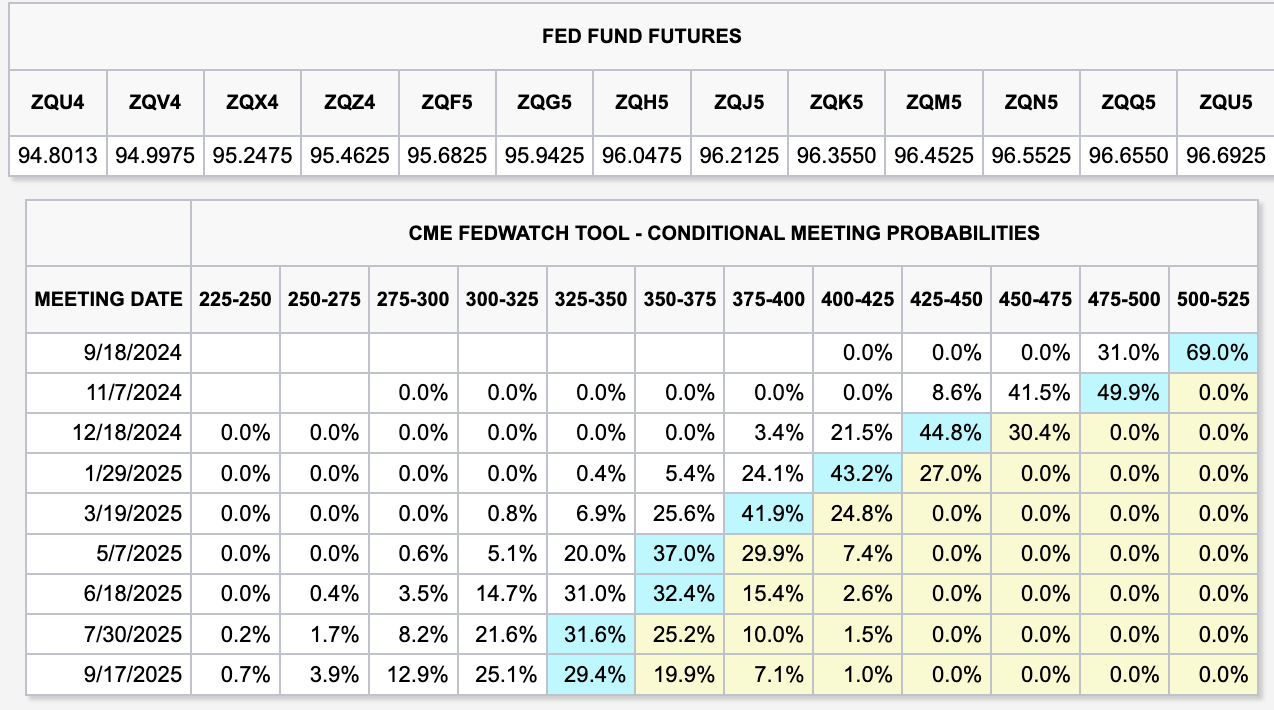

Some analysts suggest that institutional investors, who entered the market following the launch of Bitcoin exchange-traded funds (ETFs), are among those cashing out. These players may be locking in profits after riding the initial hype wave surrounding ETFs.

The ETFs themselves are showing signs of strain, with over $550 million in net outflows recorded over the past two trading days. This coincided with Bitcoin’s price retreating from near $99,000 to around $90,800. Adding to the market’s turbulence, MicroStrategy, a corporate giant with significant Bitcoin holdings, saw its stock price plummet by 35% after reaching a peak on November 21. Despite the setback, the company remains steadfast in its bullish stance, continuing to increase its Bitcoin reserves.

As the market navigates this phase, a clear divide is emerging between speculators locking in profits and seasoned holders exercising patience. Whether Bitcoin can break past the $100,000 mark remains uncertain, but all eyes are on its next move.