XRP just did a lil’ dip — nearly 8% down this week — but don’t panic. The whole market’s been chillin’ after July’s massive run. This cooldown? Lowkey healthy.

But here’s the spicy bit: XRP bounced back 4% to hit $2.98, even though trading volume dropped 25%. Translation? Smart money might be scooping bags while y’all sleepin’.

Ripple’s RLUSD Is Giving Utility King Vibes

Ripple’s not just vibes anymore — they’re building. Their new stablecoin RLUSD is gaining mad traction, with circulating supply up 32.3% in July (from $455M → $602M). That’s no joke.

Even better? A respected audit firm Bluechip gave RLUSD an A rating — reserves on point, pegging solid, regulators chill. If more exchanges and apps start using RLUSD, it’s GG — transaction volume could moon and XRP gets its glow-up.

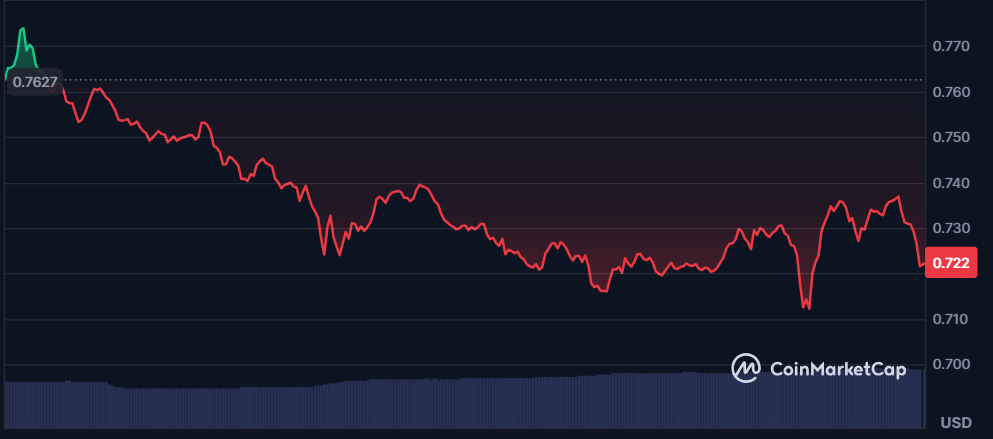

XRP Price Action: That $2.72 Bounce Looks Clean

Zoom into the 12-hour chart — XRP broke a symmetrical triangle back in July and hit $3.65 fast. After a brief RSI overheat, we got a pullback. But now? RSI is in oversold territory.

Support is looking strong at $2.72, and if buying pressure holds, XRP could run it back. Think BTC and BNB’s new ATHs? XRP might be next in line.

Oh, and with pro-crypto legislation like the Genius Act gaining traction in the U.S. and possible ETF approval rumors? That $10 XRP dream isn’t looking that crazy anymore.

Meanwhile… MAXI DOGE Is Going FULL SEND

Meme coin season isn’t over — it’s just getting started. And Maxi Doge (MAXI) is leading the new pack. This doggo doesn’t stop for red candles or weak hands.

In just a few days, MAXI raised $300K+ — all gas, no breaks. MAXI is about stacking leverage (up to 1000x ), catching every pump, and memeing your way out of your mom’s basement.

“No stop loss, no surrender, just straight moon missions.” — Every MAXI Chad, probably.

Wanna Ride the Green Candles?

Presale’s still on. You can cop some MAXI using ETH, USDT, or even a bank card. Just connect your wallet on their site (Best Wallet is vibin’ rn).

You might also like: Biggest Insane Bitcoin Heist Ever: $14.5B Loot & Zero Clues – Arkham Exposes the Silent Cyber Robbery