Ctrl Wallet, formerly XDEFI, just leveled up with a sleek new browser extension. Now you can manage crypto across 2,100+ blockchains (Bitcoin, Solana, Ethereum—yeah, all the big ones), swap tokens cross-chain, connect to dApps, and even rediscover your forgotten assets. Plus, the Gas Tank feature makes paying fees so much easier.

The Full Story

Crypto’s all about freedom, but let’s be real—managing your coins can be a hot mess. Ctrl Wallet just came through with a killer browser extension to fix that. Think of it as your all-in-one tool for handling crypto across over 2,100 blockchains, from Bitcoin to Cosmos.

What’s the vibe? Super clean and super smart. The new extension gives you a single dashboard where all your assets—from multiple accounts, seed phrases, and networks—are aggregated in one view. Lost track of that random altcoin stash? Well, there’s no worry ctrl’s got you covered.

About gas fees, well, we can all agree on hating juggling tokens just to pay transaction fees on different blockchains, but no more as we enter the Gas Tank. With this feature, you can use $USDC or $CTRL to cover fees across any blockchain. No more scrambling to hold ETH, SOL, or whatever else. CEO Emile Dubié says it best: “The Gas Tank is a game-changer.”

But that’s not all. Ctrl Wallet makes portfolio management a breeze, with cross-chain swaps and seamless dapp connections baked right in. Whether you’re a noob or a seasoned degen, setup takes just 15 seconds. That’s like, two TikToks.

Ctrl Wallet is already flexing big numbers—over 500K users and counting. It’s officially in the top 5 multi-ecosystem wallets, with glowing reviews on the Google Chrome Store. If you were one of the lucky using XDEFI, congrats, you’re already upgraded to Ctrl and can dive into all these next-gen features.

Ready to give it a spin? Head to Ctrl Wallet’s official site, download the extension, and take control of your crypto game.

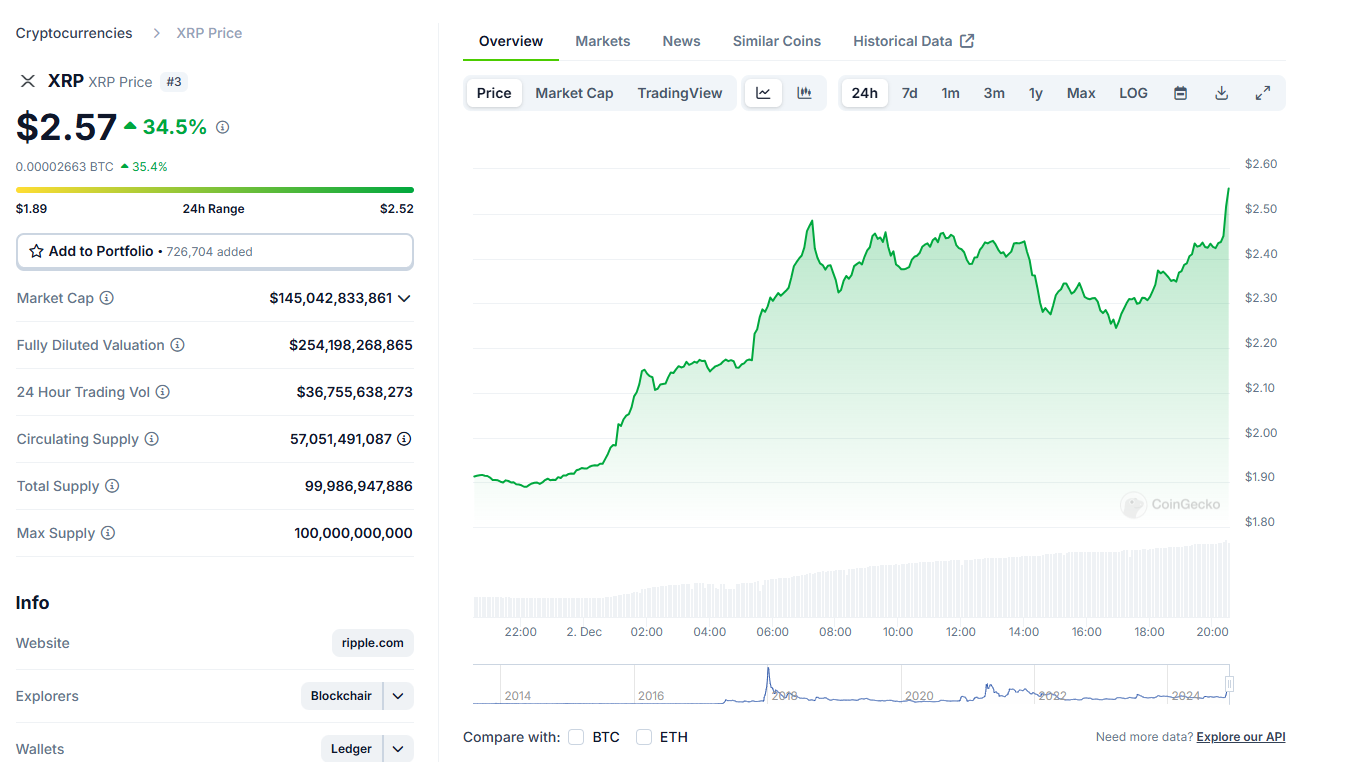

You might like: XRP Surges to Claim Spot as Third Largest Cryptocurrency