ORCA Token Moons 170% After Upbit Listing—Can It Hold the Gains?

The ORCA coin just went full send after getting listed on Upbit, South Korea’s biggest crypto exchange. In the last 24 hours, it pumped 132%, smashing through its yearly highs and peaking at $5.10 before cooling off to $3.69.

Why ORCA’s Price Popped Off

Upbit dropped a bombshell on March 21, adding its trading pairs in KRW, BTC, and USDT. The hype was real—South Korean traders piled in, sending its market cap soaring to $195.95M (+131%) and 24-hour volume exploding 6893% to $441.54M.

To prevent crazy price swings, Upbit applied restrictions:

🔹 First 5 mins: Limited buy orders

🔹 First hour: Only limit orders were allowed

🔹 Sell orders capped at 10% lower than the previous close

This controlled trading strategy helped keep the coin’s price action somewhat stable despite the massive demand.

What’s Next for ORCA?

ORCA has been on a downtrend since hitting $7 in December, but this Upbit listing has reignited the fire. However, analysts warn that RSI levels indicate an overbought zone, meaning a retracement could be on the way.

Key price levels to watch:

📉 Support: $3.50

📈 Resistance: $4.50

If it holds above $3.50, it could consolidate and make another run at $5+. But if profit-taking kicks in, expect a dip before the next move.

TL;DR: The coin just went crazy thanks to Upbit, but can it keep up the momentum? Stay tuned for the next big move.

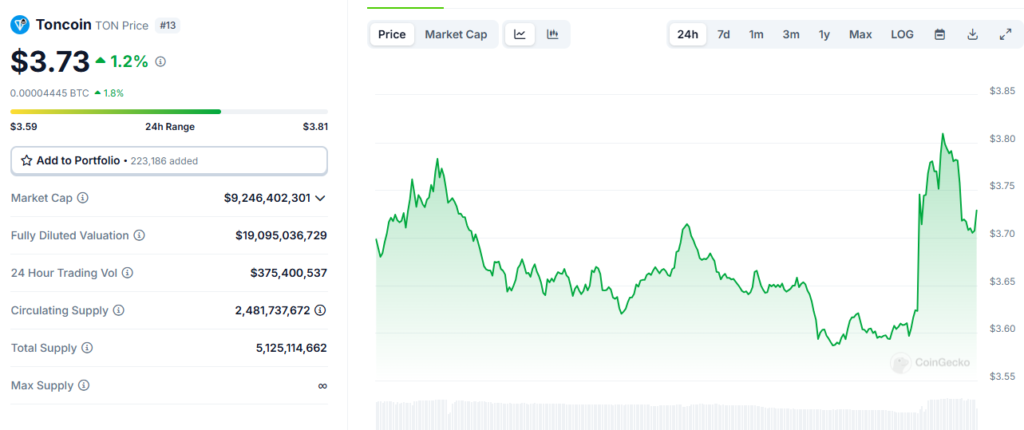

You might also like: TON Foundation Scores a Game-Changing $400M to Revolutionize Telegram Crypto