Solana is back in the spotlight—and for good reason. A bold new SEC pilot proposal could bring U.S. stocks on-chain, and guess what blockchain’s leading the pack? Yup, Solana.

The 18-month test program—submitted by the Solana Foundation, DeFi platform Orca, and asset manager Superstate—aims to tokenize equities and deliver instant trade settlement. That’s a massive W for the platform in the world of real-world asset (RWA) tokenization.

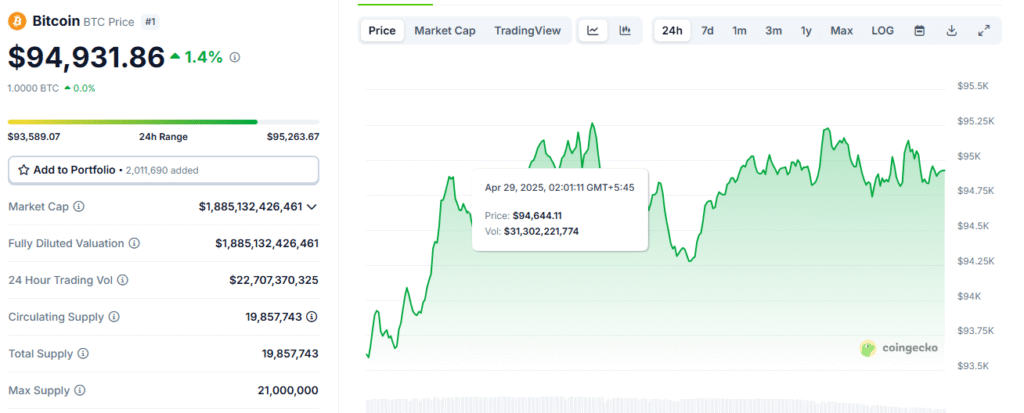

The market’s already eyeing big moves. Sol has been grinding just under its $160 resistance, but if this pilot gets the green light? That cup-and-handle pattern on the weekly chart could break hard. First stop: $190. Then? We’re talking a potential rocket ride to $350 or even $1,000.

And there’s more—Sol’s biggest weakness (scalability) might finally get patched.

Enter Solaxy ($SOLX): Solana’s first-ever Layer-2. It processes transactions off-chain, reduces congestion, and brings cheap gas back into the chat. With over $32.5M raised in presale, it’s already drawing huge hype—and fresh liquidity into the platform’s ecosystem.

Technical indicators are also vibing bullish. The MACD is on the verge of a golden cross, and RSI’s inching toward the 50 line—classic signs of a breakout brewing.

If Solana nails this moment with Project Open and Solaxy delivers, we might just be witnessing the beginning of a legendary altcoin run.

You might find interesting: Breaking ! What Happened in the Crypto World Today? | April 30, 2025