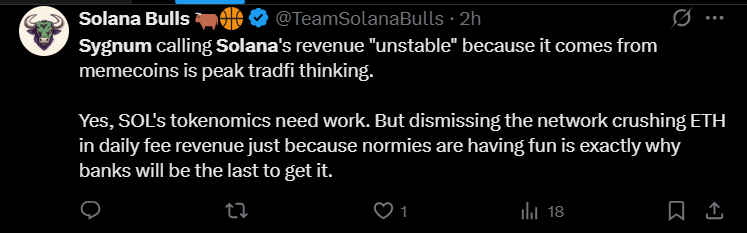

Swiss crypto bank Sygnum just gave their unfiltered take: Solana may be making noise, but it’s not ready to take Ethereum’s crown — especially in the eyes of big finance. In their latest blog (May 8), Sygnum pointed out the elephant in the room: Solana’s boom is riding on memecoin hype. That’s cool for CT degenerates, but not exactly bank-grade stable.

According to Sygnum, institutional money isn’t vibing with short-term pumps. They’re looking for security, stability, and long-term vision — three things Ethereum already flexes hard in DeFi, tokenization, and stablecoins. And yeah, even though Solana’s fee volume is spiking, most of it goes to validators, not into boosting SOL’s value.

While Solana’s DeFi game is growing, It says it still needs serious structure to get TradFi’s trust. Especially after the community voted against lowering inflation — wild move if you’re trying to boost token value.

TL;DR: Solana’s cool, but Ethereum’s the grown-up in the room. Sygnum isn’t buying the hype — yet.

You might find interesting: Breaking ! Ethereum Loses Ground as Unichain Takes 75% of Uniswap v4 Volume