Ripple just pulled off a lowkey power move, and the XRP Army is buzzing. Word on the timeline is that Ripple acquired Hidden Road, a big-shot brokerage firm that’s now registered with the FICC—a financial beast that clears over $11 trillion in trades every single day. Yeah, trillion with a T.

A sharp-eyed community member, Matthew, spotted Hidden Road on the FICC membership list and dropped the alpha on X (Twitter). Since then, it’s been making waves in the crypto scene—and for good reason.

So what’s the big deal? FICC runs its massive volume through something called the Government Securities Division, and now Ripple has the backstage pass. That means XRP, RLUSD (Ripple’s new stablecoin), and the XRPL infrastructure could end up settling, collateralizing, or fee-ing their way through Wall Street levels of liquidity.

To put it in perspective:

🚨 1% of FICC’s daily flow = $110B

Even that sliver running through XRPL could throw major demand behind XRP—and unlike your fave memecoin, XRP burns fees with every use, which tightens supply.

The price side of things? XRP is currently chilling around $2.37, down 2.24% but up 340% over the past year. Analysts are watching $2.27 as key support. If XRP bounces, the next target is $3.30, and if the hype holds, maybe even $5.85, according to crypto chart guru Dark Defender.

Some bold predictions?

🔮 $10–$15 XRP by 2027

🔮 $20 XRP by 2030 if adoption keeps snowballing

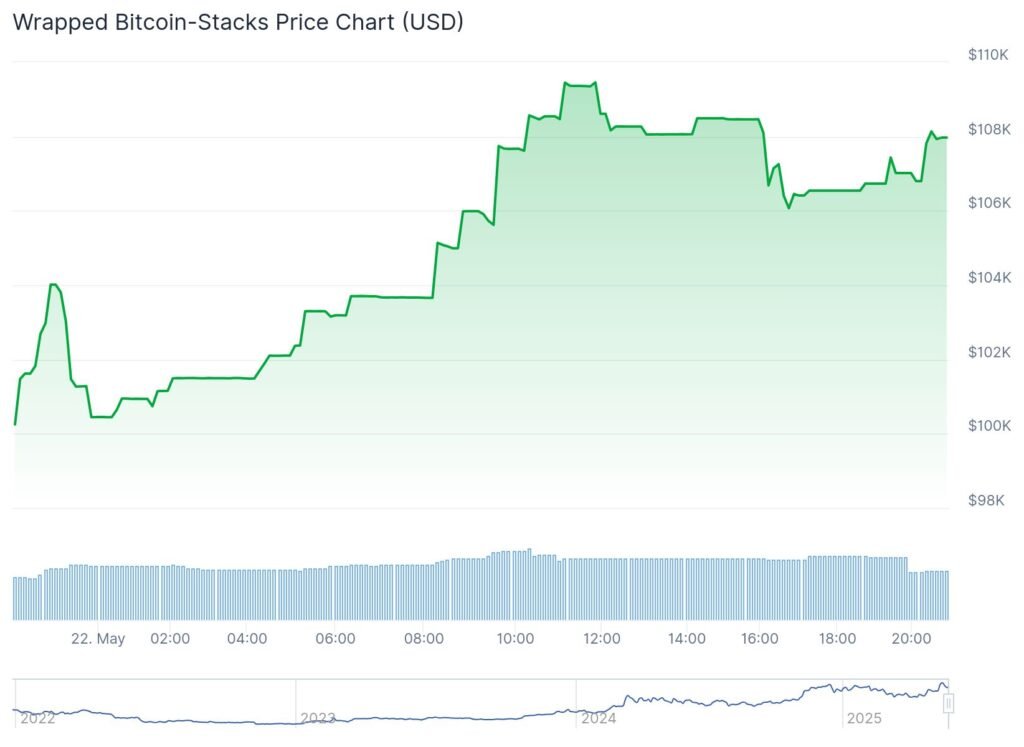

Back in 2017, XRP pulled an 869% moonshot in a month. Could we be seeing a 2017 repeat with this Hidden Road plug? With BTC hitting ATHs again, the timing couldn’t be better.

So yeah, Ripple’s playing the long game—and it might just pay off big.

You might find interesting: $111M Short: James Wynn Flips Bearish on Bitcoin After Closing $1.25B Long