No, Ripple Is Not Burning 10% of XRP—Here’s the Real Story

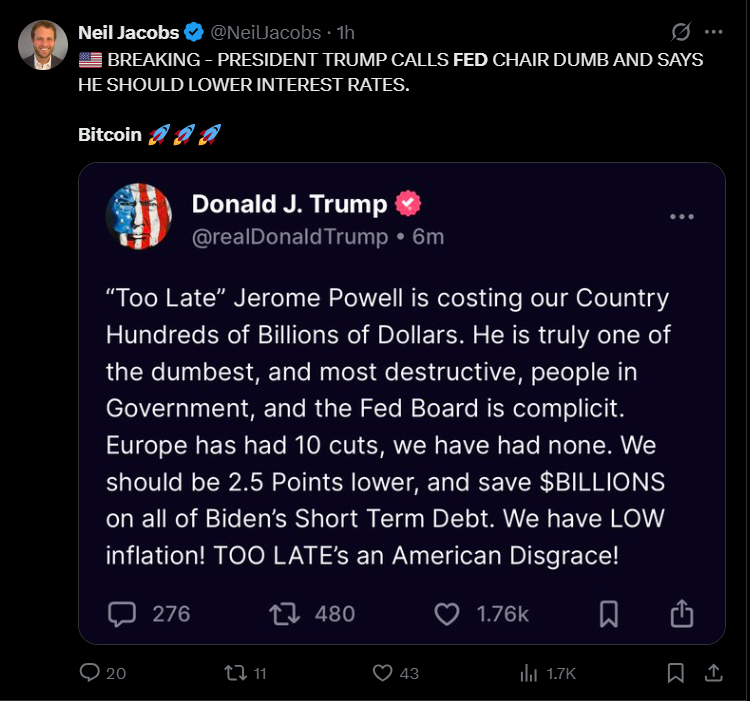

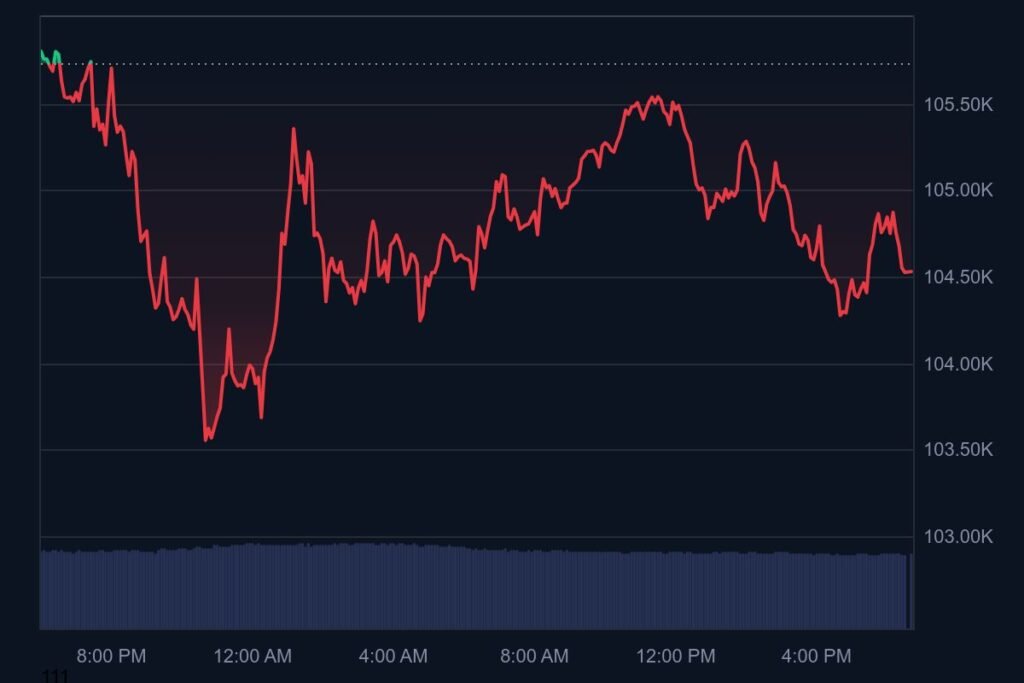

Rumors sparked by an X user, CryptoGeek, claimed that Ripple would burn 10% of XRP supply within 48 hours, supposedly leading to a price spike to $125.98. He referenced old chats and historic burns from 2017 to support the claim.

But here’s the truth:

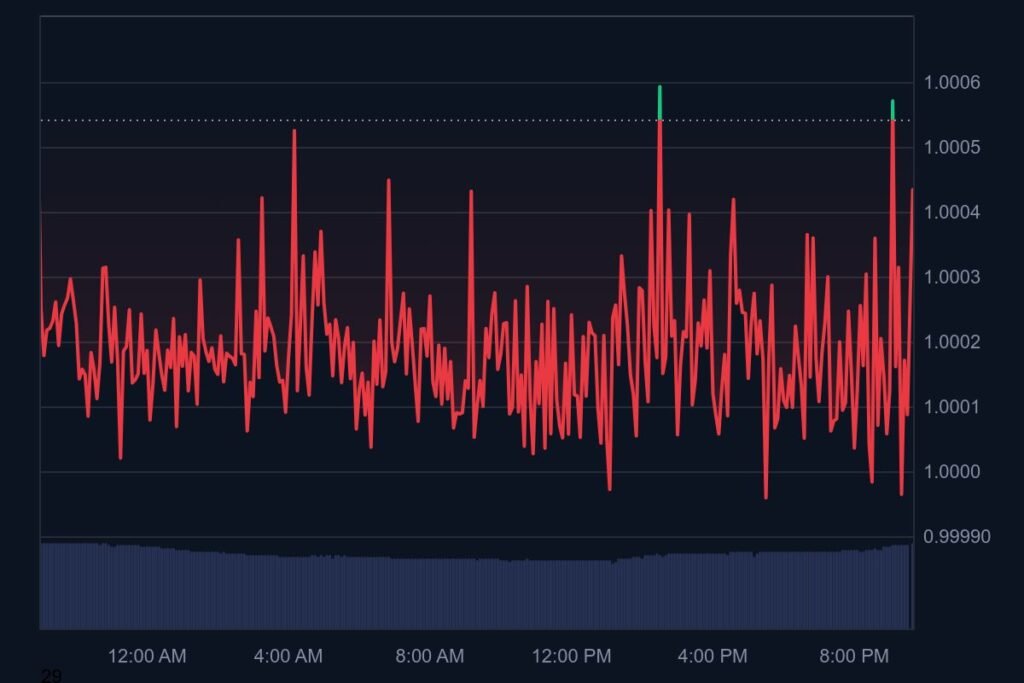

🔸 XRPScan confirms that only 13.9 million tokens has ever been burned—and that’s over the entire life of the Ledger.

🔸 That burn happens automatically via small transaction fees—not through planned supply cuts.

🔸 Burning 10% would mean removing 10 billion XRP—over 700 times more than what’s been burned in total. That’s simply not realistic.

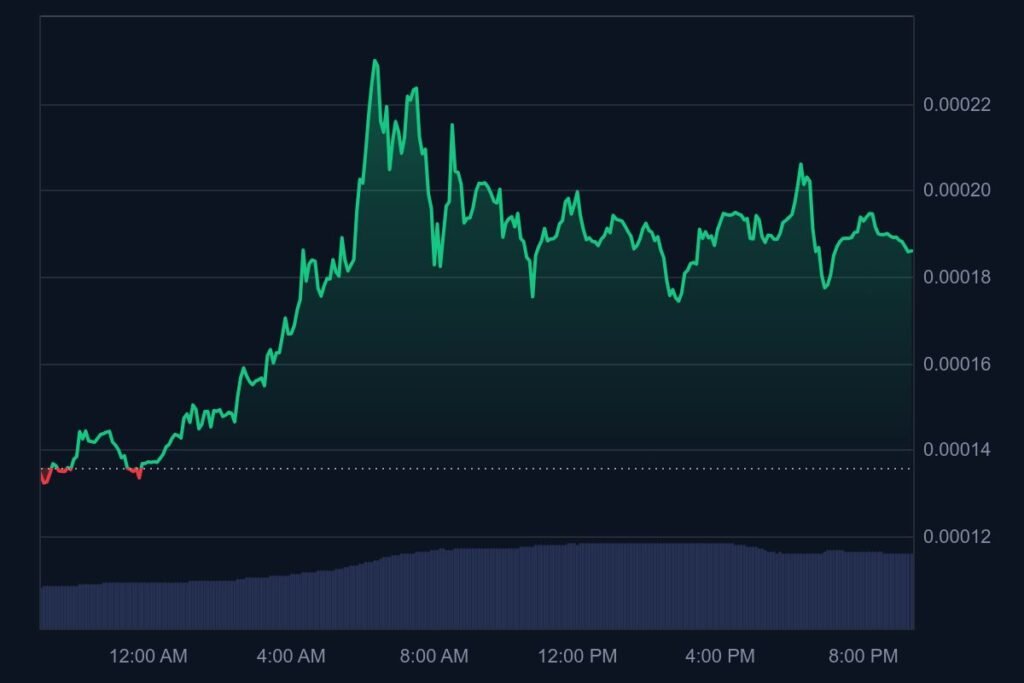

This rumor most likely came from confusion around RealFi, a token project on the Ledger that announced it would burn 10% of its own supply—not the token’s. Since the post mentioned “XRP Ledger” and “burn,” it created major FUD online.

Fact check: Ripple has no mechanism or history of burning the token on this scale. The network’s design only allows for micro-burns via usage-based fees.

Always verify before you buy into the hype.

You might also like: GOUT Memecoin Explodes 1000% in a Week — Hits New All-Time High