Back in 2009, when Bitcoin was barely a newborn, early crypto legend Hal Finney made a wild prediction: Bitcoin could hit $10 million per coin. Yeah, you read that right.

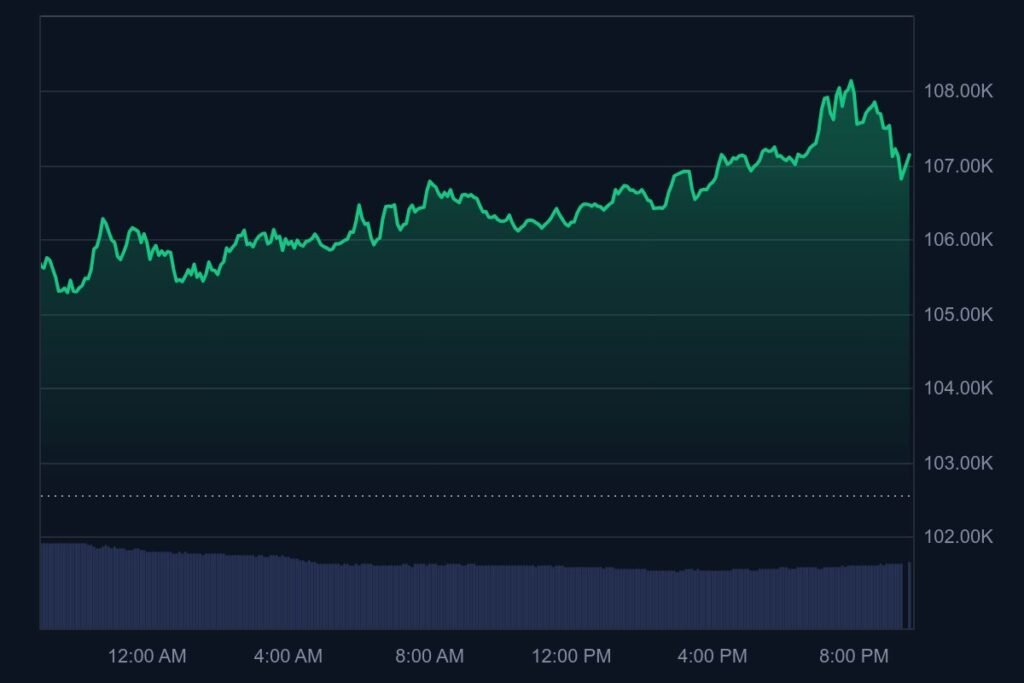

Fast forward to June 2025—Bitcoin’s cruising around $108K, and Finney’s hot take is making waves again after being reposted by @BitcoinNews21M on X. But this wasn’t some moonboy pump—it was a serious thought experiment. Finney imagined a future where it replaces all fiat money, becoming the world’s go-to currency.

Here’s the math: the 2024 Credit Suisse Global Wealth Report says the world’s total household wealth is around $305 trillion. Divide that by its fixed 21M supply = roughly $14.5M per BTC. Suddenly, $10M doesn’t sound that crazy.

Finney was no rando—he worked with Satoshi, received the first-ever BTC transaction, and helped pioneer the reusable PoW system. He also saw fiat money losing power ever since it got unpegged from gold in the 1970s. The Bank for International Settlements even said most major currencies lost 90%+ of their value since then.

Sure, haters say this kind of mass adoption is a dream. But zoom out: in just 15 years, Bitcoin went from a few cents to over $100K. With institutional money rolling in and inflation eating away traditional money, the tides could turn.

Will we see $10M BTC soon? Probably not tomorrow. But Hal’s vision? It still hits different.

You might also like: Kraken Launches Krak: New Global P2P App to Rival PayPal and Cash App