In a quiet but definitive close to one of crypto’s early DAO experiments, DAOstack officially ceased operations in 2022 after running out of funds—despite raising nearly $30 million during the 2017–2018 ICO boom.

According to ICO Drops, DAOstack raised:

- $21.9M from a private round

- $4.69M in a presale

- $3.39M from a public ICO

The project aimed to build a decentralized governance protocol for DAOs, but it never lived up to its fundraising hype.

By the end of 2022, it had formally shut down, citing treasury depletion. Despite its early promise, its native GEN token never even hit its original token sale price during its entire run.

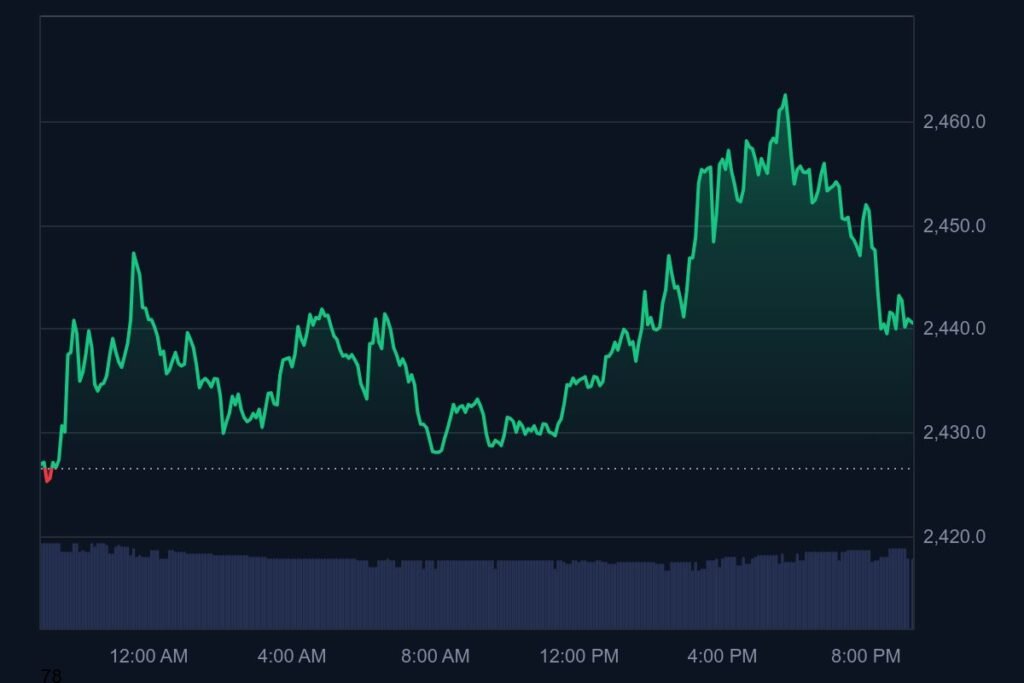

📉 GEN Token Collapses Below One Cent

The token now trades at $0.001422, dropping another 2.71% in the last 24 hours, according to Dexscreener. At its peak, GEN failed to reclaim its ICO price, and by May 2021, it began its long descent—now worth virtually nothing.

- Current Market Cap: $68.18K

- Token Price: $0.001422

- 24-Hour Change: –2.71%

🧬 DAOstack’s Legacy Lives On Through xStocks

Interestingly, DAOstack’s impact persists in a new form. According to LinkedIn, three co-founders of Backed Finance, the team behind the tokenized stock marketplace xStocks, are former DAOstack employees.

While GEN may be dead, its DAO-building ethos has evolved, carried forward by a new generation of Web3 builders working on regulated on-chain assets.

⚠️ Final Take: Another ICO-Era Cautionary Tale

DAOstack’s shutdown is a sobering reminder of the boom-and-bust cycle of early crypto startups. Despite a massive treasury, poor execution and lack of traction led to collapse—leaving investors with nearly worthless tokens.

Yet, as seen with xStocks, talent rarely disappears—just pivots. DAOstack might be gone, but its alumni are now shaping the tokenized finance wave.

You might also like: Strategy to Report $14B Profit on Bitcoin Surg