The BNB Foundation has successfully executed its 32nd quarterly token burn, permanently removing more than 1.59 million BNB tokens—valued at approximately $1.02 billion—from circulation. Conducted on the Smart Chain (BSC), the burn involved both the platform’s Auto-Burn feature and the Pioneer Burn Program, as per the official statement released by Chain.

The Auto-Burn system is a supply-control mechanism that eliminates excess tokens each quarter by sending them to an irreversible “blackhole” address. This method supports long-term ecosystem health by increasing token scarcity, stabilizing price movements, and aligning with its roadmap of eventually reducing the total supply to 100 million token.

“The latest burn involved 1,595,470.69 BNB via Auto-Burn and 129.10 through Pioneer Burn,” the announcement noted.

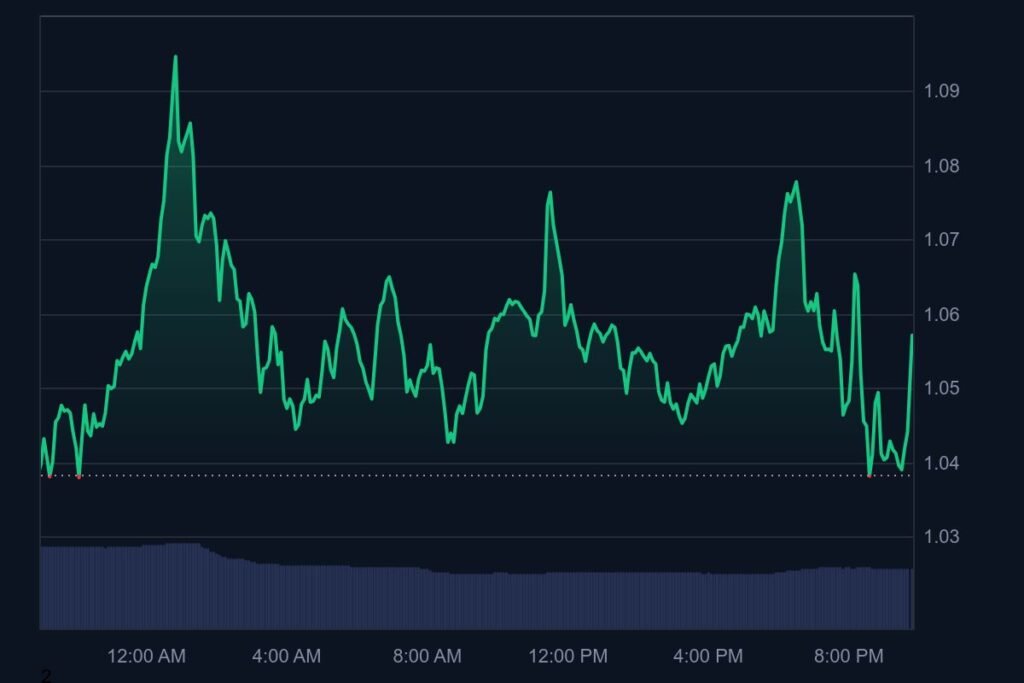

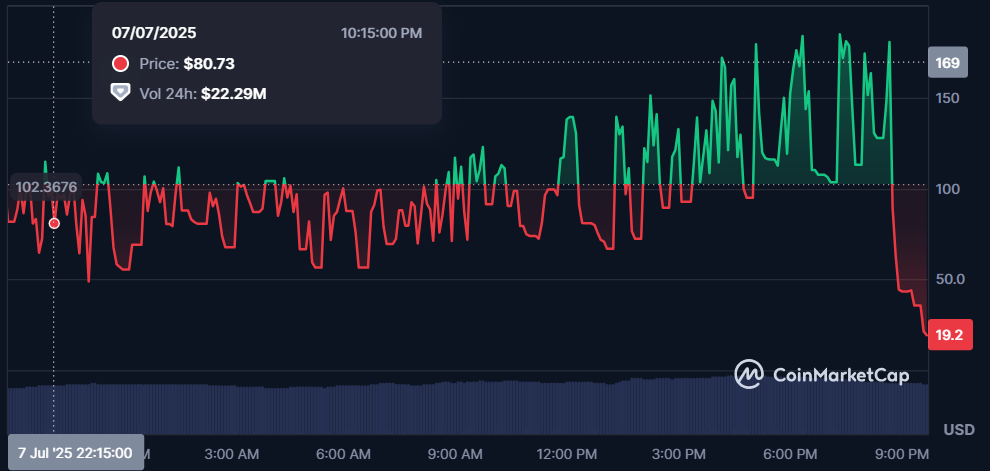

At the time of the burn, it was trading around $670, with a daily trading volume of $1.77 billion and a market cap exceeding $93.5 billion. The deflationary action adds confidence to its value proposition as a key asset powering BSC, opBNB Layer 2, and Greenfield blockchain.

Recent upgrades like Lorentz and Maxwell have improved block production speeds, necessitating a slight adjustment in the Auto-Burn formula to reflect the enhanced chain efficiency.

New Horizons: BNB Treasury Company Eyes U.S. Stock Listing

In a parallel development, YZi Labs—a venture backed by Binance founder CZ—announced its support for the Treasury Company, which plans to go public in the United States. This move could give traditional investors regulated access to the ecosystem, potentially increasing its visibility and adoption.

You might also like: Kraken and Backed Expand Tokenized xStocks to BNB Chain