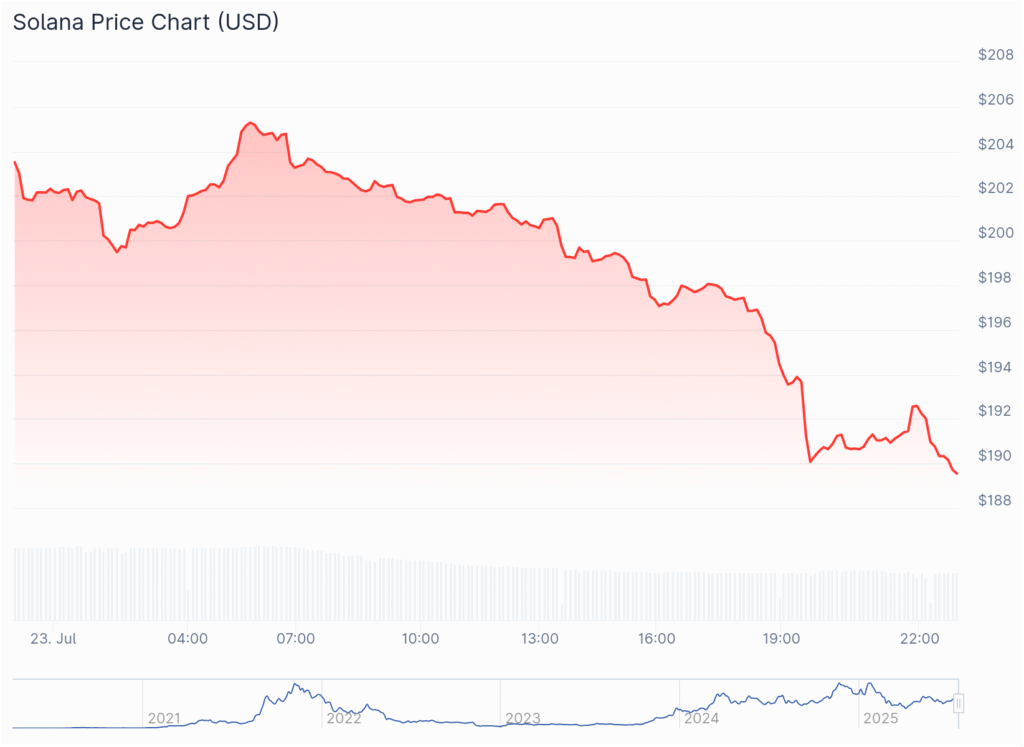

Solana (SOL) has sparked excitement among crypto investors with a 19% price surge this week, driving a wave of gains across its ecosystem. One standout is Fartcoin (FART), a popular Solana-based meme coin, which soared nearly 30% during the same period. This upward momentum follows Upexi Inc.’s massive $273 million SOL purchase and the launch of Jito Labs’ BAM protocol, both reinforcing confidence in the network.

The Altcoin Season Index rising to 56 signals growing interest in altcoins beyond Bitcoin. Fartcoin’s futures market is particularly hot, with open interest surpassing $1 billion — roughly 65% of its $1.66 billion market cap — outpacing heavyweights like Litecoin and Chainlink. This surge highlights speculative retail trading fueled by its bullish breakout above $175 resistance.

Crypto analyst $0uL on X points out Fartcoin’s chart mirrors Solana’s breakout pattern, sitting near a $1.61 resistance level. A successful breakout could push prices higher. Additionally, Based Fartcoin on the Base chain is showing promising bullish consolidation, hinting at further ecosystem growth.

The ongoing price correlation between Solana and Fartcoin suggests the altcoin season could be just getting started, with many tokens ready to ride Solana’s momentum upward.’

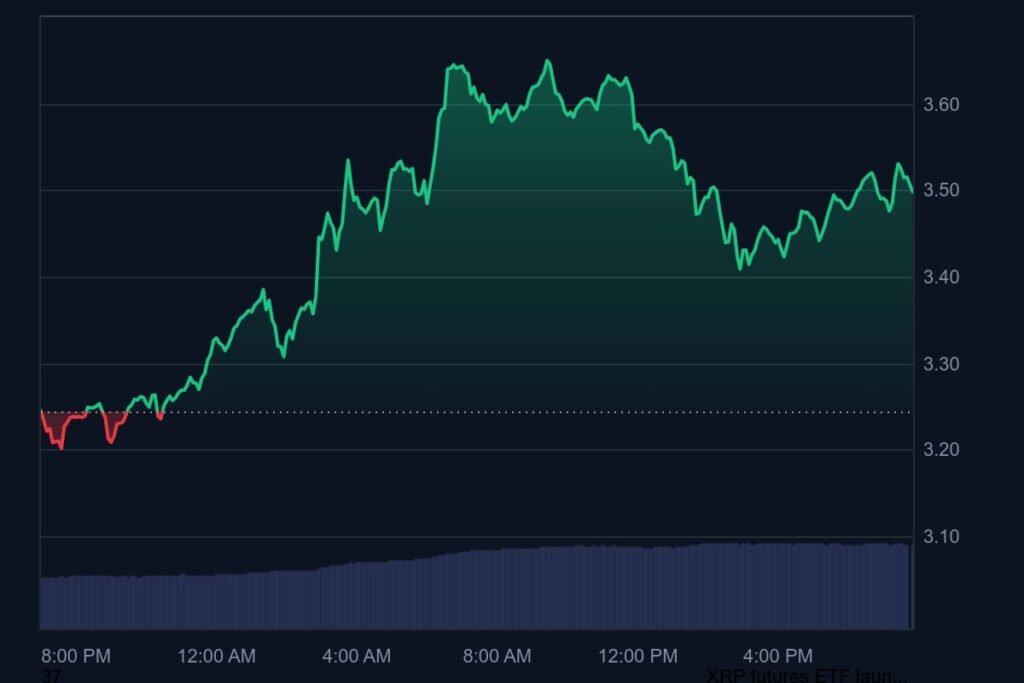

You might also like: XRP Price Prediction: XRP Eyes $4 After Surpassing McDonald’s Market Cap