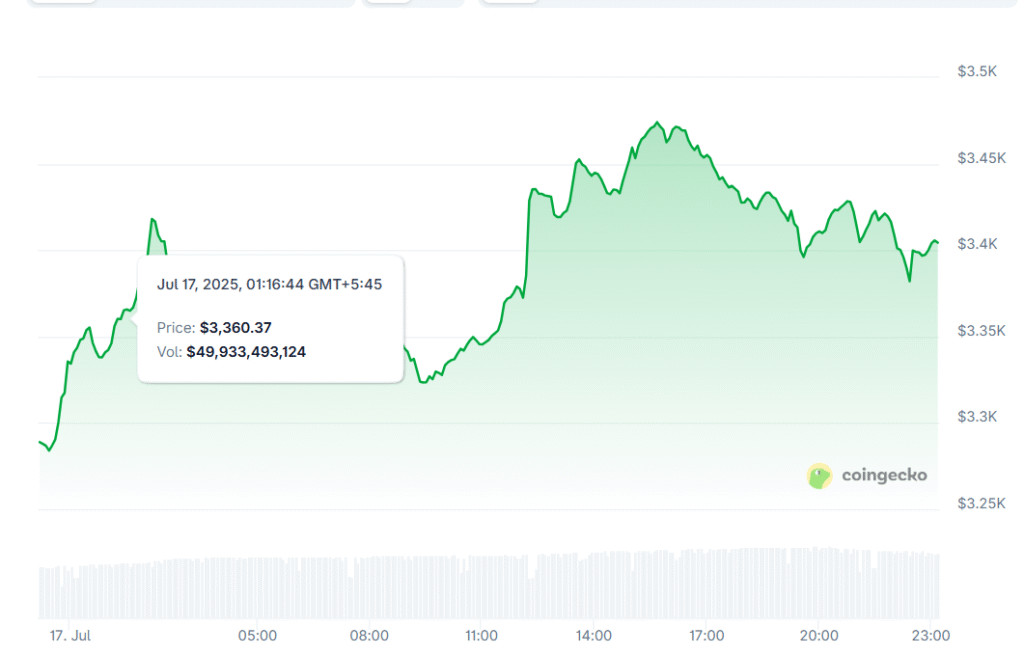

Ethereum is soaring as institutional and retail demand align, driven by U.S. regulatory progress. This week, ETH rallied past $3,400 after spot Ethereum ETFs recorded their highest-ever single-day inflows of $726.6 million, signaling strong traditional finance interest. Open interest has also surged to a record $46 billion, according to Coinglass, amplifying volatility and pushing ETH’s weekly gains over 20%.

Fueling the rally is the advancement of key U.S. crypto legislation—the CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance State Act—all contributing to growing confidence in Ethereum’s long-term outlook.

Technical charts show ETH breaking out from an ascending broadening wedge, with a target of $3,750 if resistance at $3,480 breaks. Indicators like RSI and MACD remain bullish, although the 0.786 Fibonacci level at $3,190 could act as a pullback zone.

At the same time, HODLers are moving ETH off exchanges into self-custody wallets like MetaMask, Exodus, and Best Wallet ($BEST). The latter is gaining attention for its innovative “Upcoming Tokens” discovery tool.

With strong fundamentals and technicals aligning, Ethereum’s breakout could extend toward $3,750 and even retest all-time highs if bullish momentum continues.

You might also like: Bitcoin Today: 4 Bold Signals Pointing to a Rally Toward $130K