The REX-Osprey Solana + Staking ETF ($SSK) has made an explosive debut, pulling in over $20 million in a single day, and pushing its total assets under management (AUM) to more than $40 million—just days after its launch.

Launched on July 3, $SSK is the first U.S.-listed Solana ETF that directly holds and stakes SOL tokens. This unique model sets it apart from other crypto ETFs that merely track asset prices. With staking rewards of 7.3% annually, paid out monthly, $SSK offers both price exposure and yield, making it a highly attractive option for investors seeking passive income in crypto markets.

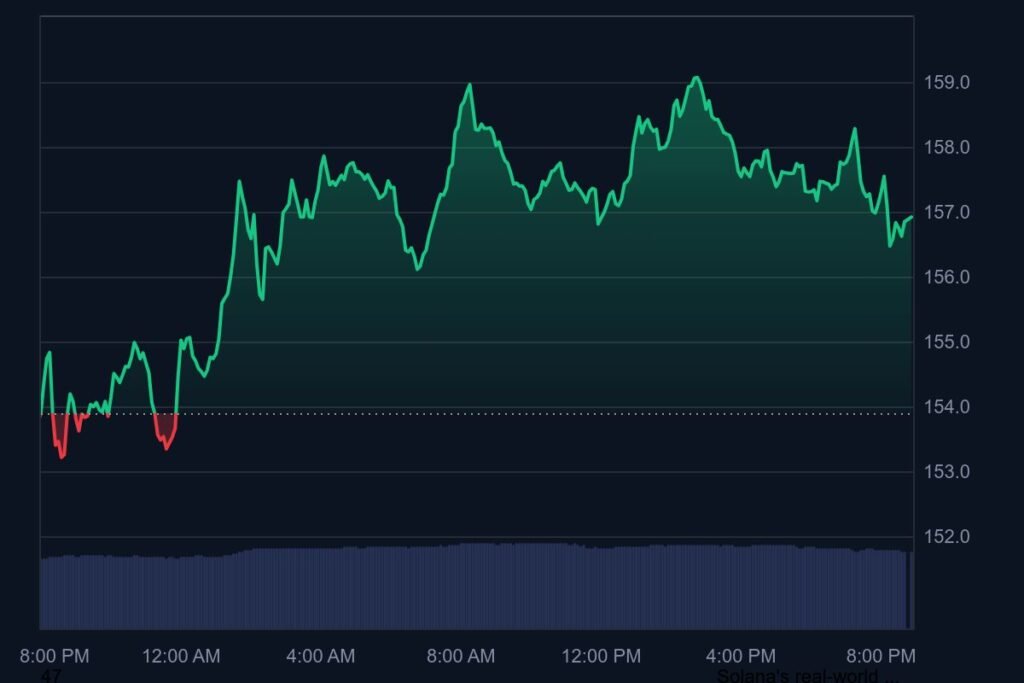

“A lot of green numbers = good,” summed up Eric Balchunas, Bloomberg’s senior ETF analyst, who predicted early success for the fund.

📈 Rapid Growth and Volume Milestones

- On Day 1, $SSK had $1 million AUM and saw $33 million in trading volume

- Within days, AUM jumped to $40M+

- $20M was added in one day alone

This performance surpassed expectations and helped $SSK outpace rival funds like $SOLZ and start closing in on $SOLT, a 2x leveraged Solana ETF. Combined, the three Solana-focused ETFs have brought in around $80 million in the last month, doubling total inflows in the Solana ETF segment.

💹 Why Investors Are Flocking to $SSK

The appeal of $SSK lies in its:

- Real Solana exposure (not futures or derivatives)

- Staking yield of ~7.3% annually, paid monthly

- Regulatory transparency as a U.S.-listed product

- Rising institutional and retail confidence in Solana’s ecosystem

While still small compared to Bitcoin or Ethereum ETFs, $SSK’s early success signals a growing appetite for yield-bearing crypto investment products in regulated markets.

You might also like: Kraken and Backed Expand Tokenized xStocks to BNB Chain